Your NYSLRS pension can provide a significant portion of your retirement income, but it’s also a good idea to supplement your pension and Social Security with a retirement savings account.

Retirement savings can be an important financial asset when you retire. Savings can enhance your retirement lifestyle and give you the flexibility to do the things you want. Your savings can provide money for you to travel, continue your education, pursue a hobby or start a business. The money you set aside can also be a resource in case of an emergency, act as a hedge against inflation and boost your retirement confidence.

Set a Retirement Savings Goal

How much to save is a personal decision, but here are some things to consider.

Financial advisers often recommend saving 10 to 15 percent of your gross earnings throughout your career to retire comfortably. However, that advice is aimed at people with 401(k)-style defined contribution retirement plans as their main source of retirement income.

As a NYSLRS member, you’re part of a defined benefit plan, also known as a traditional pension plan. Your pension, based on your years of service and earnings, will provide a lifetime benefit. You can estimate your pension in Retirement Online to get an idea of the income it will provide in retirement.

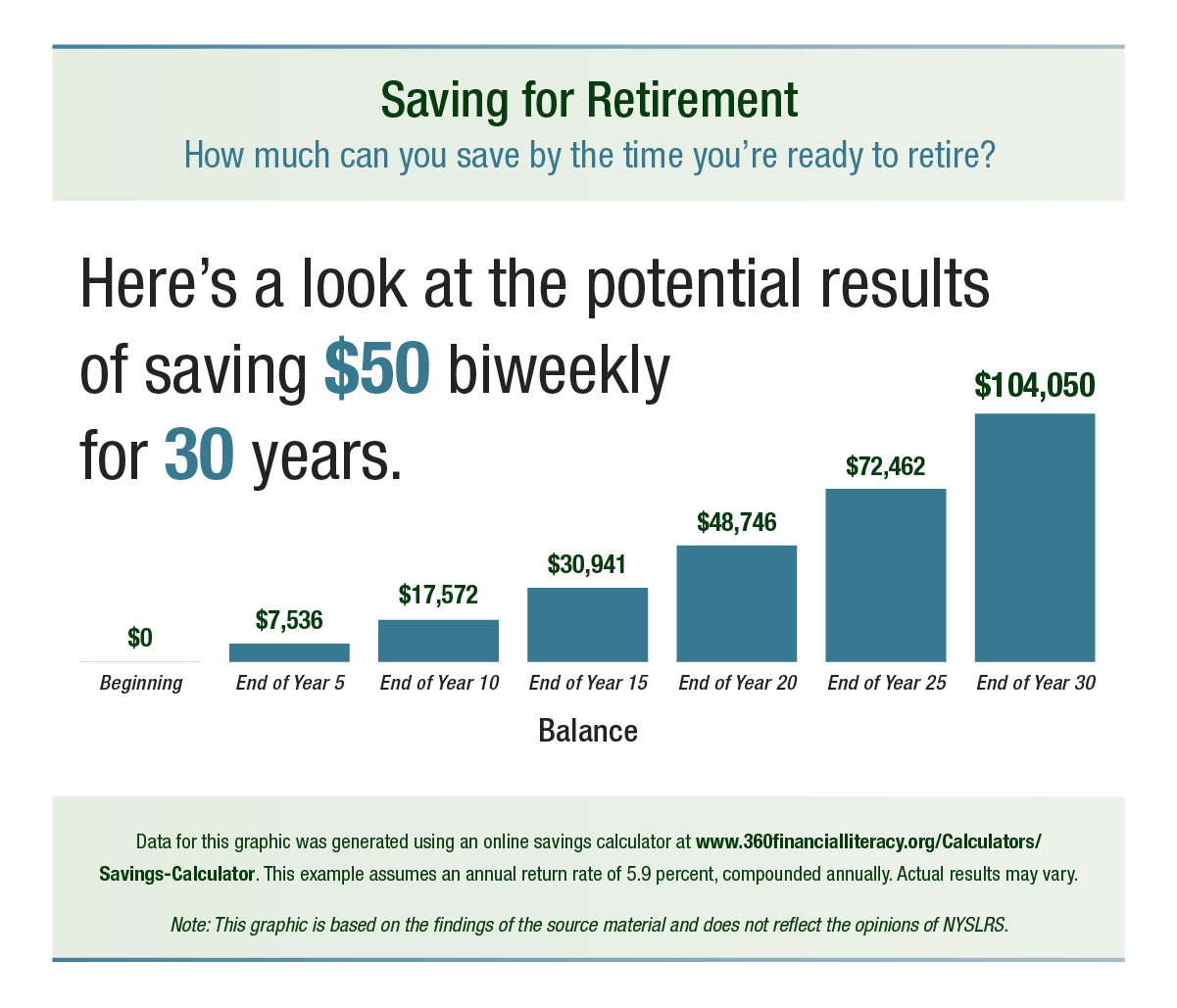

Having a pension means you may not need to save as much as someone with only a 401(k). Use a retirement savings calculator to see how much a retirement savings plan could yield over time, or test the results of different savings amounts.

Below you can see potential savings results of someone who invests 50 dollars every two weeks over 30 years. While the stock market can be turbulent over the long term, stock market returns average about 10 percent a year.

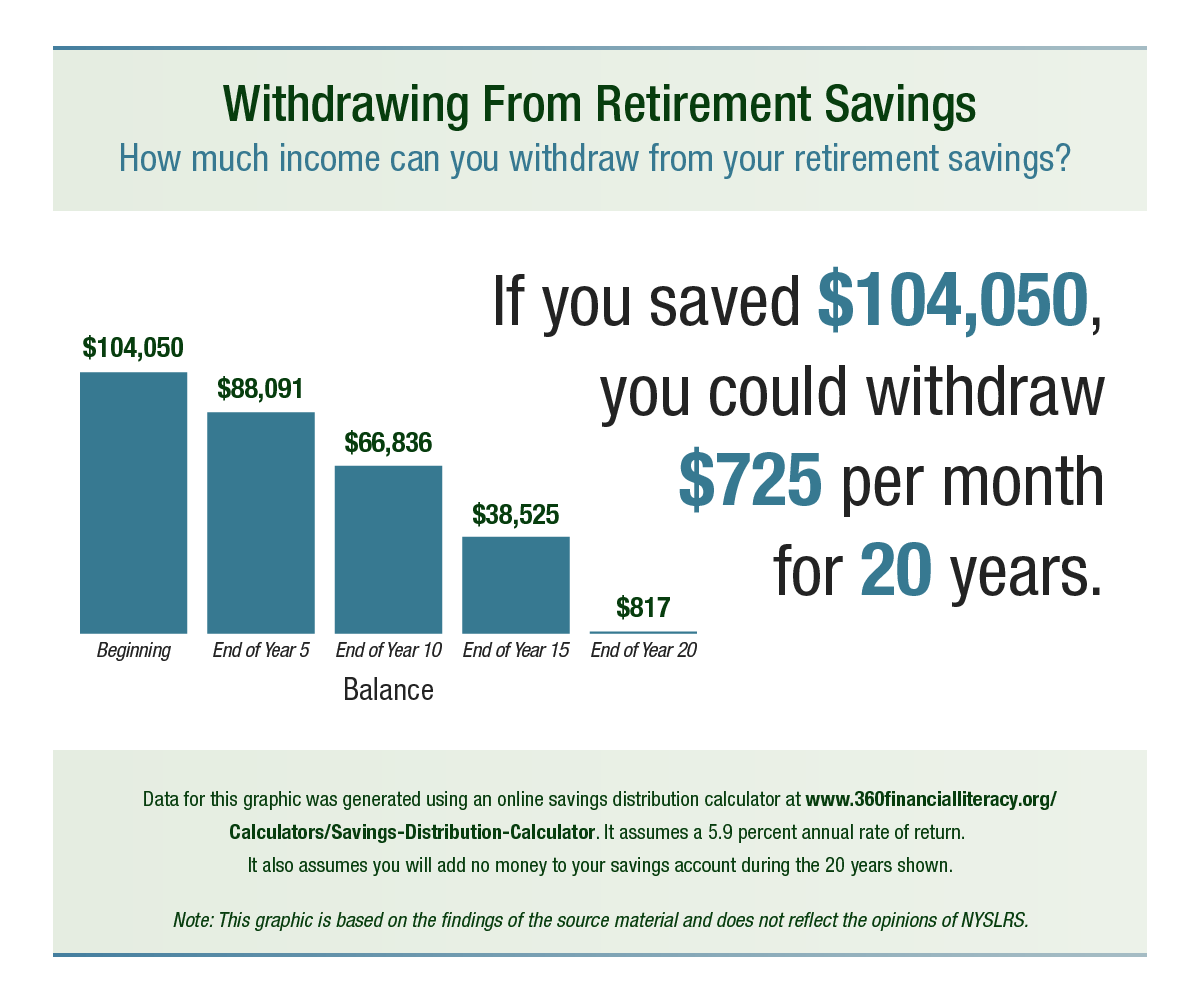

As you get closer to retirement, you should develop a plan to withdraw money from your retirement savings. A withdrawal plan will give you a better idea of the income you might expect from your nest egg.

Here is one possible withdrawal strategy, which was designed to provide retirement income for 20 years. Please note, if your retirement is far in the future, the money you withdraw may not have the same value that it has today. However, while inflation has been high recently, it does cycle and has been lower in the past.

If you find you’ll need to save more to meet your goal, you can make adjustments to help ensure you’ll have enough savings in retirement.

Deferred Compensation – A Way to Save

State employees and many municipal employees are eligible to save for retirement through the New York State Deferred Compensation Plan. Once you’ve signed up, your retirement savings, which may be tax-deferred, depending on your plan, will be automatically deducted from your paycheck. (The Deferred Compensation Plan is not affiliated with NYSLRS.)

Check with your employer’s human resources or personnel office to see if they participate in the Deferred Compensation Plan or if they offer other savings options.

Read More About Retirement Savings

You can find more information about saving for retirement in these posts:

How do I change my the account # where you send my retirement?

The fastest way to update your bank account number or to change banks is to sign in to your Retirement Online account. From the top of your Account Homepage, in the ‘I want to…’ section, click the “Update Direct Deposit” link.

You can find more information on our Direct Deposit Program webpage.

You can do the Deferred Comp as a Roth 457, that avoids the tax & tax bracket issues, also required minimum distributions (RMD) aren’t necessary if in Roth.

How do we make it as a Roth 457..

If you have a question about deferred compensation, please call the New York State Deferred Compensation Plan at 800-422-8463 or visit their website.

Dont recommend deferred comp..when you take out at retirement,feds hit you with taxes and higher tax bracket and you wind up paying.