If you’re planning to retire soon, it’s a good idea to take inventory of any debt you owe. Paying down your debt can give you flexibility to enjoy the type of retirement you want.

NYSLRS Loan Debt

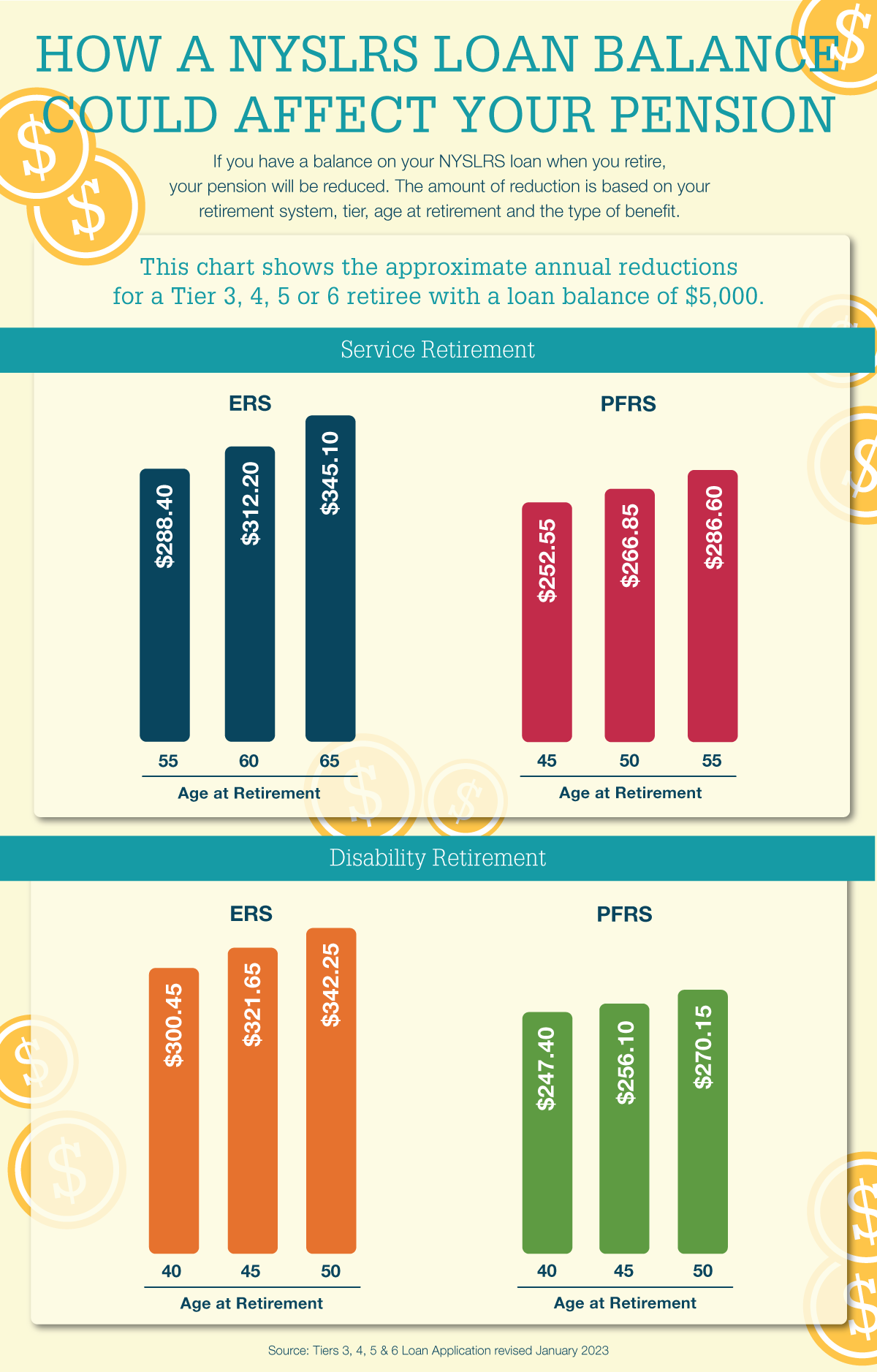

If you have an outstanding NYSLRS loan balance when you retire, it will reduce your pension. The amount of your reduction is based on:

- Your retirement system — Employees’ Retirement System (ERS) or Police and Fire Retirement System (PFRS);

- Your tier;

- Your age at retirement; and

- Whether you retire with a service retirement benefit or a disability retirement benefit.

The pension reduction does not go toward repaying the outstanding loan balance — it’s a permanent reduction. And, at least part of the loan balance at retirement will be subject to federal income taxes.

When you apply to retire using Retirement Online and have an outstanding NYSLRS loan balance, the pension reduction amounts are provided to you. They are also listed on the loan applications on our Forms page. If you are nearing retirement, be sure to check your loan balance. If you are not on track to repay your loan before you retire, you can increase your loan payments, make additional lump sum payments or both (see the Change Your Payroll Deductions or Make Lump Sum Payments section of our Loans page.)

Although ERS members may repay their loan after retiring, they would have to pay the full balance that was due at retirement in a single lump sum payment. Then, going forward, the pension would be increased to the amount it would have been without the loan reduction. However, it would not be increased retroactively back to the date of retirement.

Other Debt to Check

Credit Cards

Another priority is paying off credit cards. Credit card statements carry a minimum payment warning that tells you how long it will take, and how much it will cost, to pay off your balance making only minimum payments.

If you have more than one credit card balance, many financial advisors recommend you pay as much as you can on the card with the highest interest, while making at least the minimum payments on lower-interest cards. Once you’ve paid off the high-interest card, focus on the one with the next-highest rate, and so on. Other advisors say it might be better to pay off the card with the smallest balance first. The idea is to gain a sense of accomplishment, and make the process seem less daunting.

Mortgages

Should you try to pay off your mortgage before you retire? Advice varies on that question. It would eliminate a major expenditure and let you spend your retirement income on other things. On the other hand, if your mortgage interest rate is relatively low, you may want to focus on paying off other high-interest debt or boosting your retirement savings. What works best for you will depend on your situation.

Empire insurance needs to be looked at , i pay close to $6000 a year and they don”t pay hardly nothing

NYSLRS doesn’t administer health insurance programs for its retirees. For questions about the New York State Health Insurance Program’s (NYSHIP) Empire Plan that is available to New York State retirees and some municipal retirees, please contact the New York State Department of Civil Service.

Since my retirement in October 2019, I’ve reflected back on my retirement finance planning and want to share my real life experiences with you.

I gutted out my working life reaching my 20 years of Civil Service at age 69 and delayed taking Social Security until age 70, 8 months after retirement. The other part of my reirement income was from my contributions to tax deferred savings while working which gave me 3 sources of income. At the time of retirement I had no debt, no mortgage, no loan from the retirement system, no car payments. My advice is, set yourselves up in the best possible financial position to succeed during your retirement years. Good luck!

Why doesn’t everyone receive the COLA? All of these people have worked for the majority of the years they’ve been alive and paid into social security since the very first paycheck they received. With prices increasing daily on almost everything, what makes you think some people don’t need this increase? Yet, “we” can pay out our hard earned money that we’ve contributed to those who’ve never worked a day in their life (Medicaid, food stamps, etc.)?? This was first set up to be available for people when they retire and is only right since they made contributions.

Once again, the rich get richer, the poor get handouts, and the middle class gets nothing.

I concure. When you retire from state service you should immediately ( no 5 year waiting period) start to get colas. This needs to be addressed.

Talk to your legislators. We can’t do that while in State service (at least some of us can’t), but retired employees get their citizenship rights back.