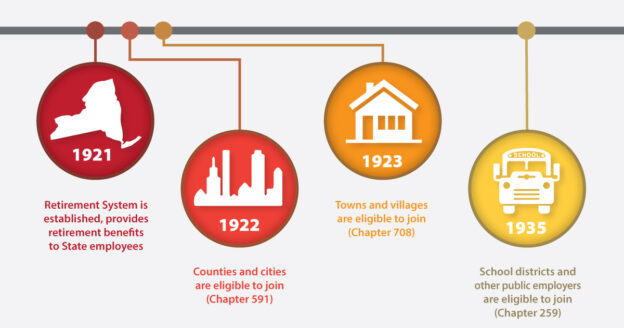

Retirees Contribute: A Century of Economic Impact

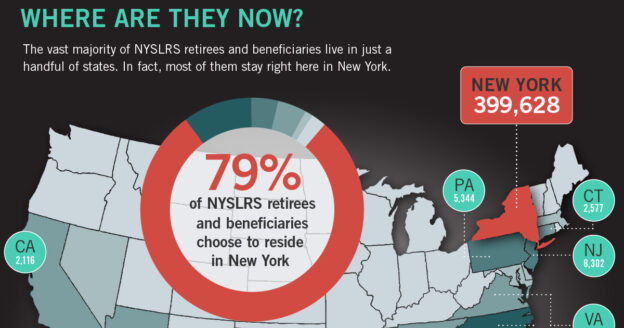

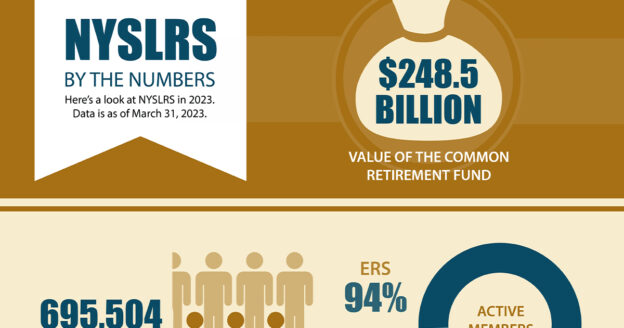

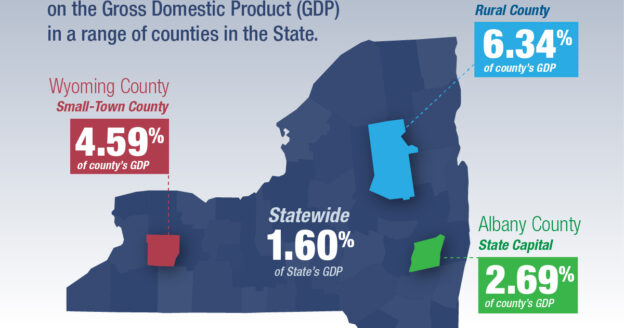

Over the past century, NYSLRS has provided pension security for retired public workers, whose spending has contributed to the economic strength and stability of their communities. In every corner of the Empire State, NYSLRS retirees shop at local stores and patronize local businesses, which in turn helps create jobs. NYSLRS retirees also pay a significant […]