Retroactive payments are lump sum payments you receive from your employer. These payments can be from new union contracts, arbitration awards or legal settlements that took place while you were on your employer’s payroll.

If you receive a retroactive payment from your employer, it could affect your pension benefit calculation.

How Retroactive Payments Can Affect Your Benefit

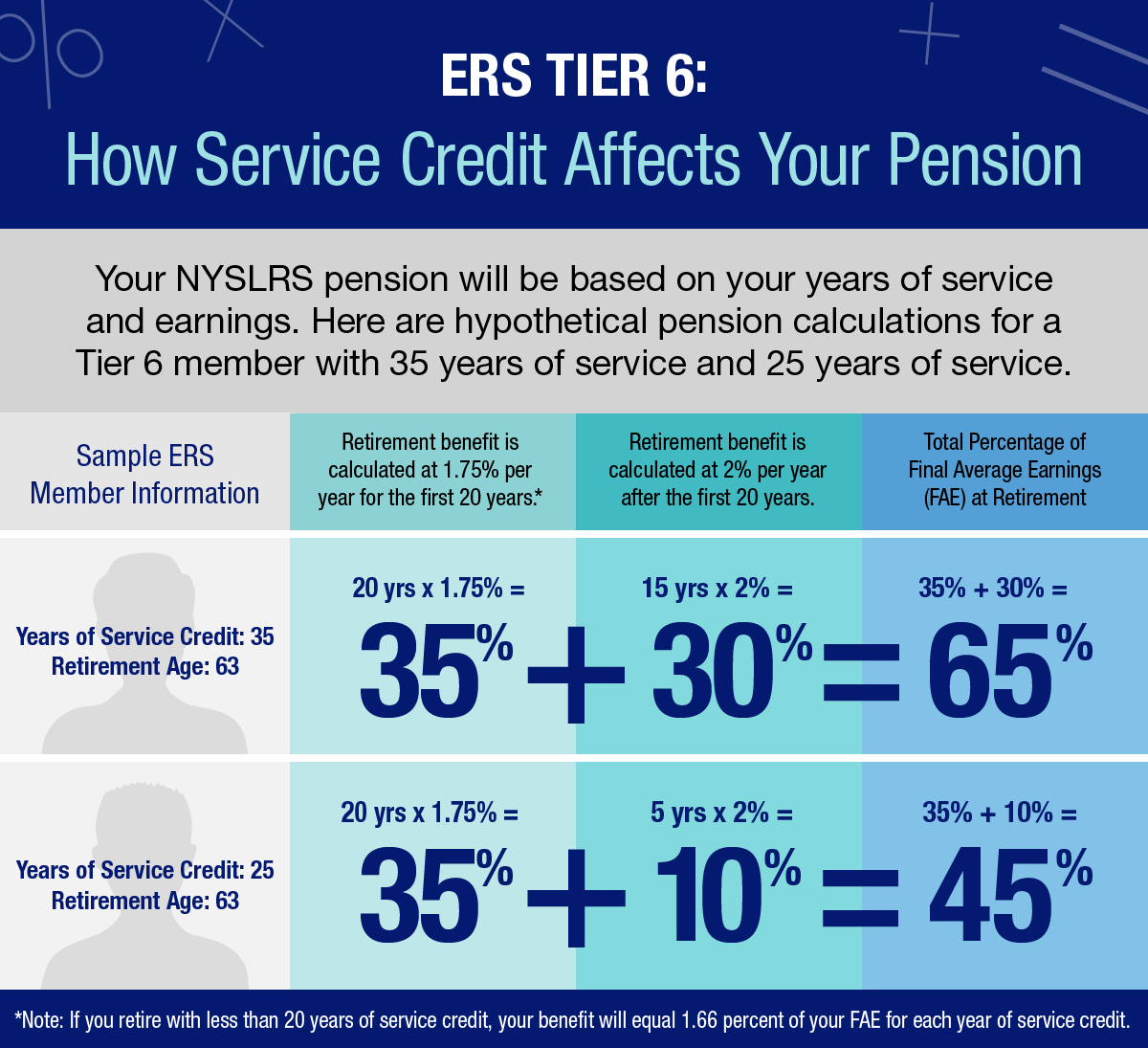

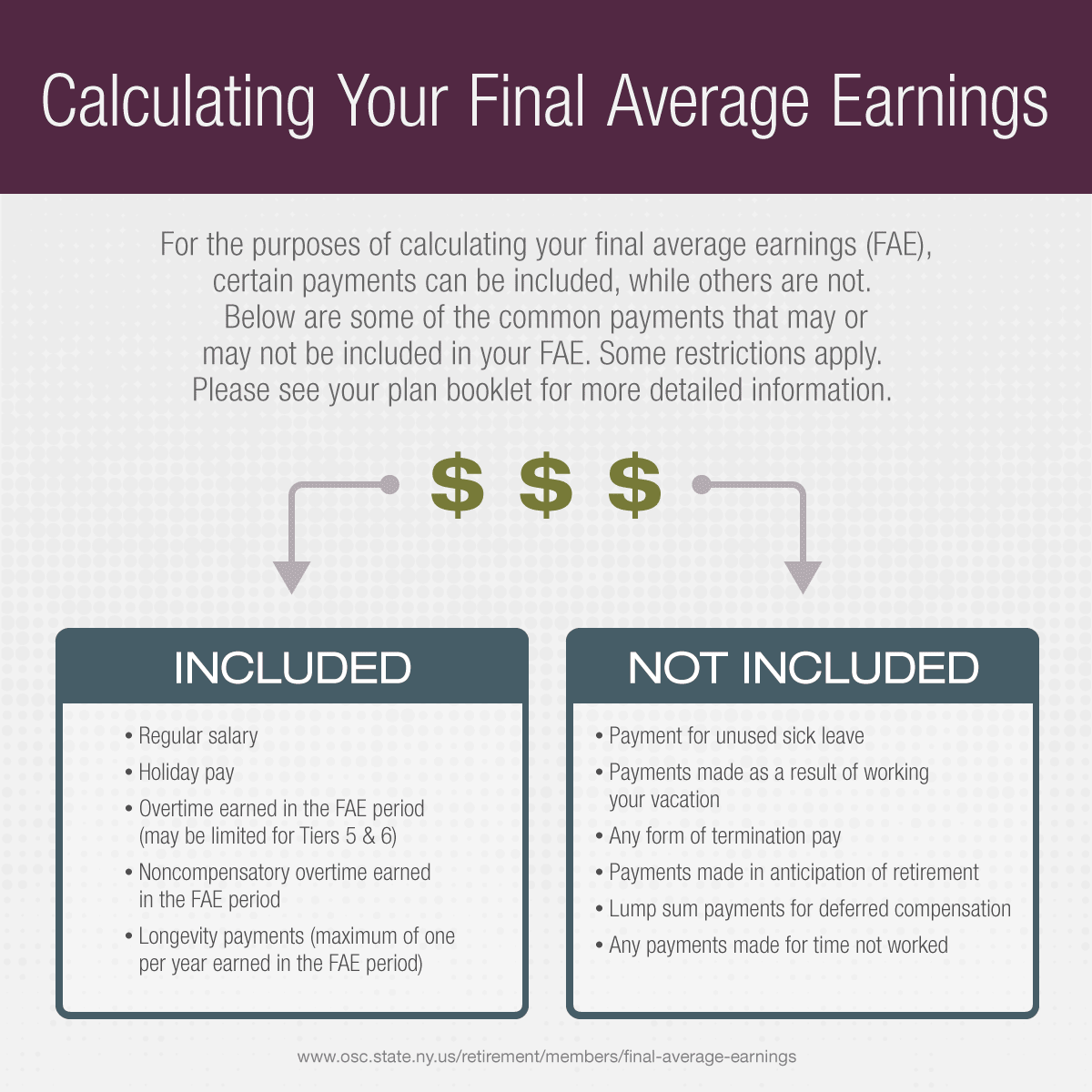

Your final average earnings (FAE) are a major factor in your pension benefit calculation. It’s the average of your three (five for Tier 6 members) highest consecutive years of earnings. For most people, their highest years of earnings come at the end of their careers.

Retroactive payments are applied to the pay periods when they were earned, not when they were paid. So, retroactive payments can increase your FAE, and therefore your pension benefit, as long as the time period in which you earned that money is part of the time period your FAE is based on.

However, please be aware that the law limits the FAE of all members who joined on or after June 17, 1971. For most members, if your earnings increase significantly through the years used in your FAE, some of those earnings may not be able to be used toward your pension. You can find information about earnings limitations by tier, including examples, on the Final Average Earnings page on our website. If your FAE has already been affected by these earnings limits, your retroactive payment will not increase your pension benefit.

Payments Received Before Retirement. If you receive a retroactive payment from your employer before you retire, your employer will report your earnings to us through their regular reporting process. You do not need to notify us of payments you receive.

Payments Received After Retirement (State Employees). If you retired from New York State and you receive a retroactive payment after you retire, we will recalculate your pension automatically. NYSLRS receives State payroll information automatically and you do not need to notify us. You will receive correspondence from us explaining any change in your pension benefit.

Payments Received After Retirement (Non-State Employees). If you retired from a non-State employer and you receive a retroactive payment after you retire, send a letter to our Recalculation Unit in the Benefit Calculations & Disbursement Services Bureau. Please include a copy of your check stub and any correspondence you received from your employer related to the payment. Mail it to:

NYSLRS

Attn: BCDS – Recalculation Unit

110 State Street

Albany, NY 12244-0001

You can also email and upload this information to the Retirement System through our secure contact form.

Your Pension Recalculation Will Be Completed

We continue to receive a record number of pension recalculations and are working diligently to address them. If you are currently waiting for your pension amount to be recalculated, please rest assured that we will get to it. Once we complete your recalculation, you will receive payment of all the money you are owed, and a letter explaining the change in your pension amount.

Recent PEF Retroactive Payments

If you were a Public Employees Federation (PEF) member before retiring from State service, you may have recently received a retroactive payment. The current PEF contract, covering employment from April 1, 2019 through March 31, 2021, was ratified last summer. If you were a PEF member, worked during these dates and have not received your retroactive payment, please check with your previous employer.

If you retired recently and your FAE included earnings from on or after April 1, 2019, your NYSLRS pension will be increased automatically. You do not need to notify us that you received a retroactive payment.

CSEA Contract Negotiations

If you were a member of the Civil Service Employees Association (CSEA) before you retired, your contract and any retroactive payment is currently being negotiated. Contact CSEA if you have questions.