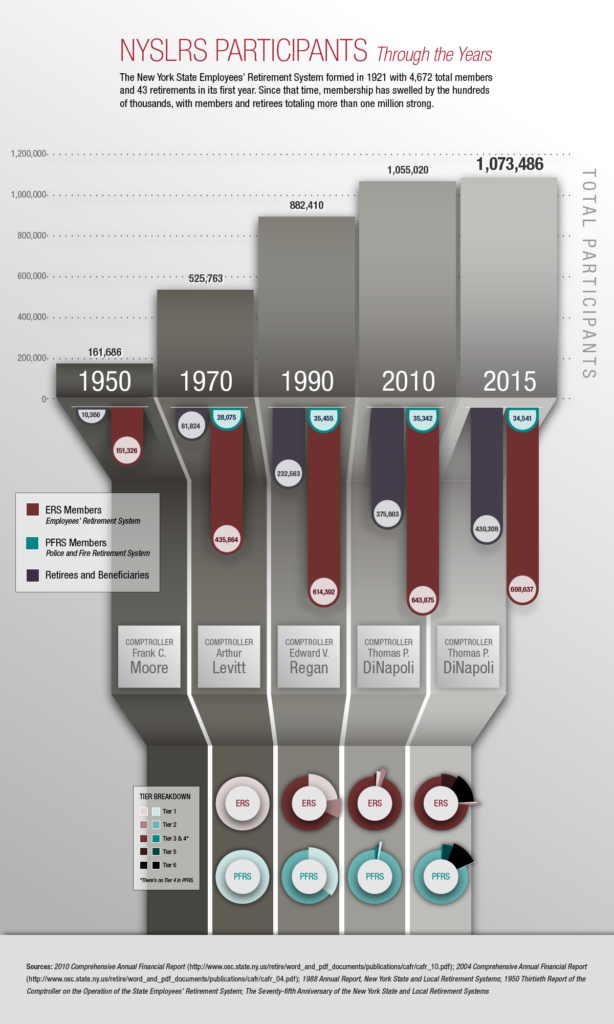

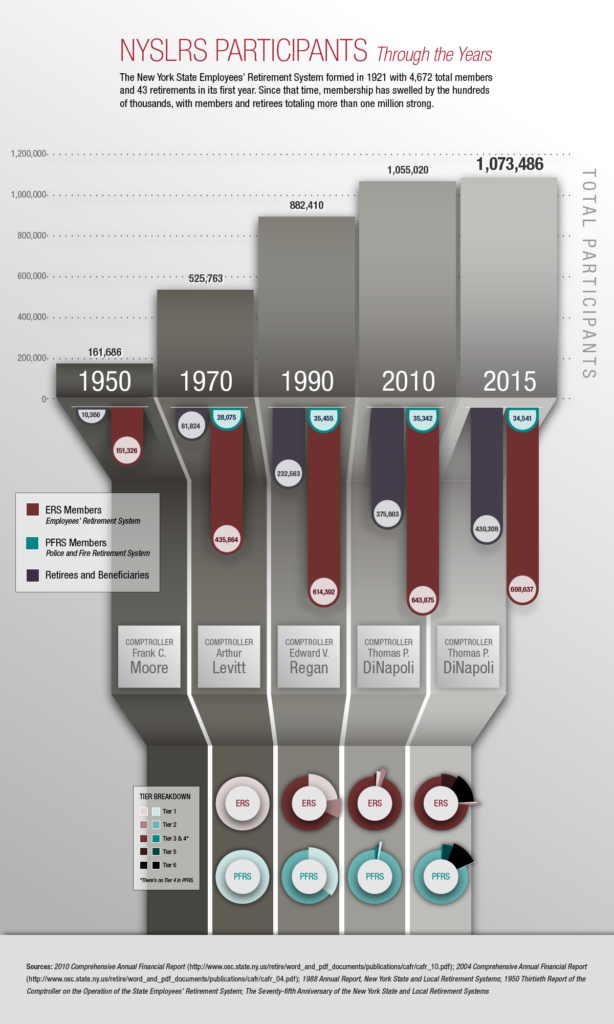

When NYSLRS formed in 1921, it started with a total of 4,721 participants (4,672 members and 43 retirees). Today, NYSLRS provides retirement security to 643,178 members and 430,308 retirees and beneficiaries (the most recent data available).

To say we’ve grown would be an understatement. But no matter how large we get, NYSLRS will continue to provide its members and retirees with lifetime retirement benefits and help them to plan for a financially secure future.

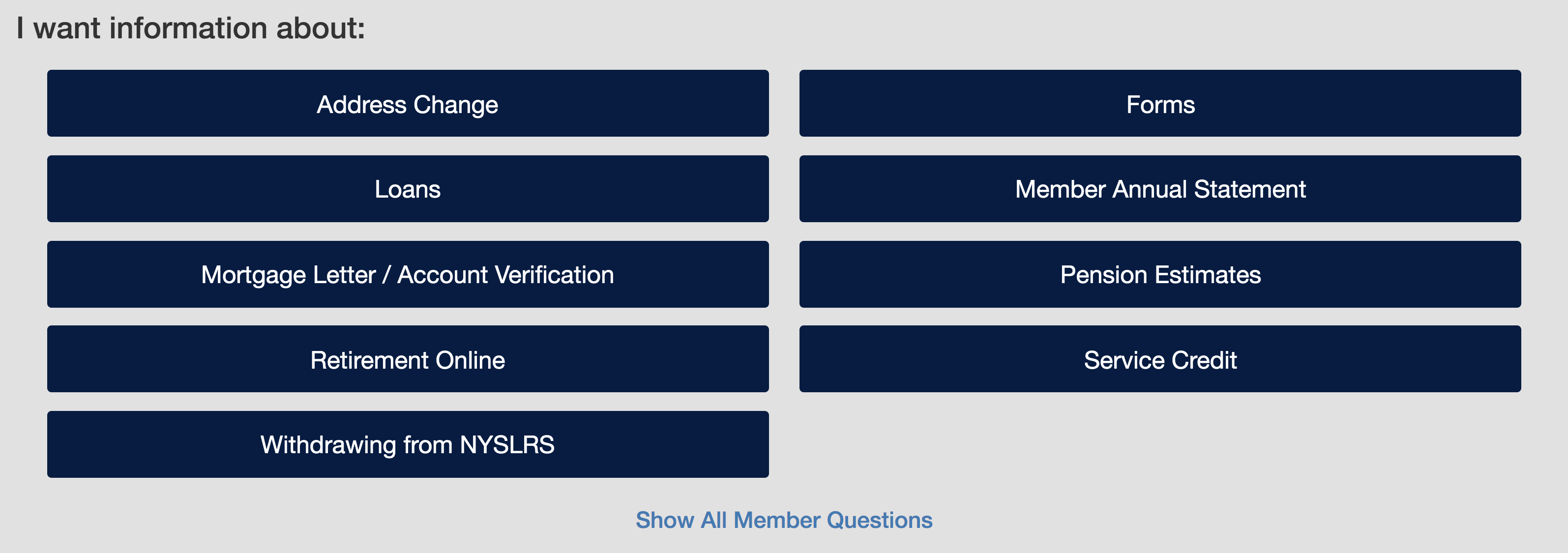

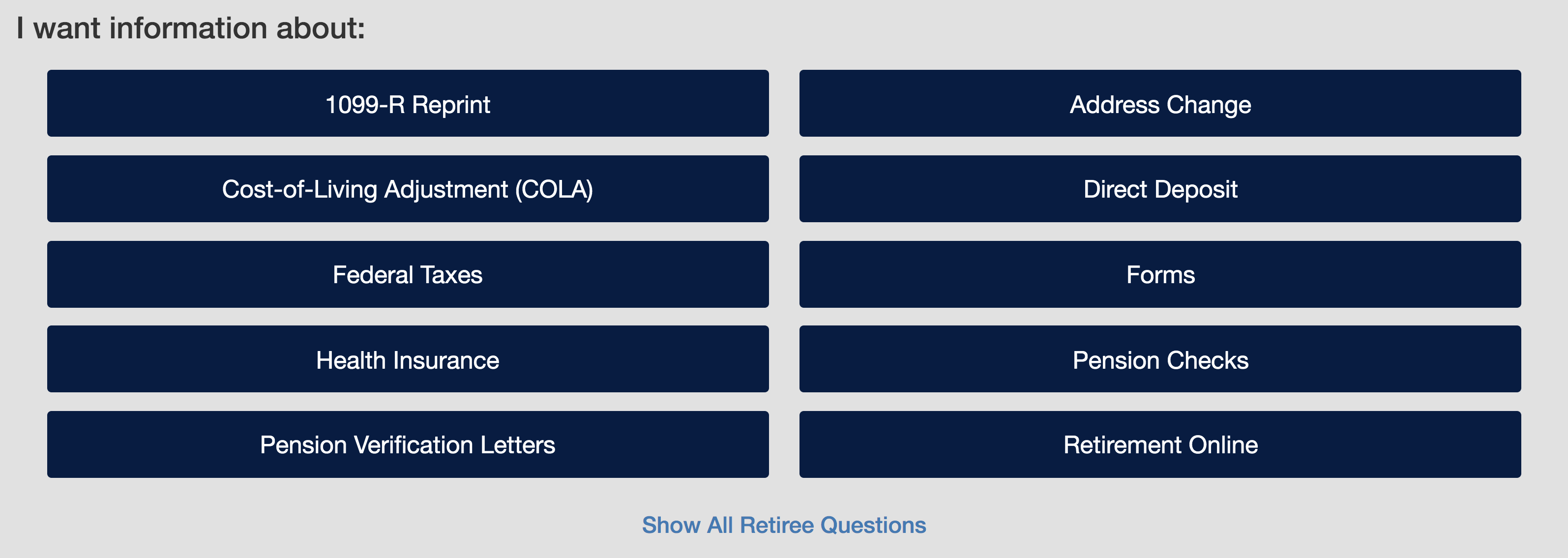

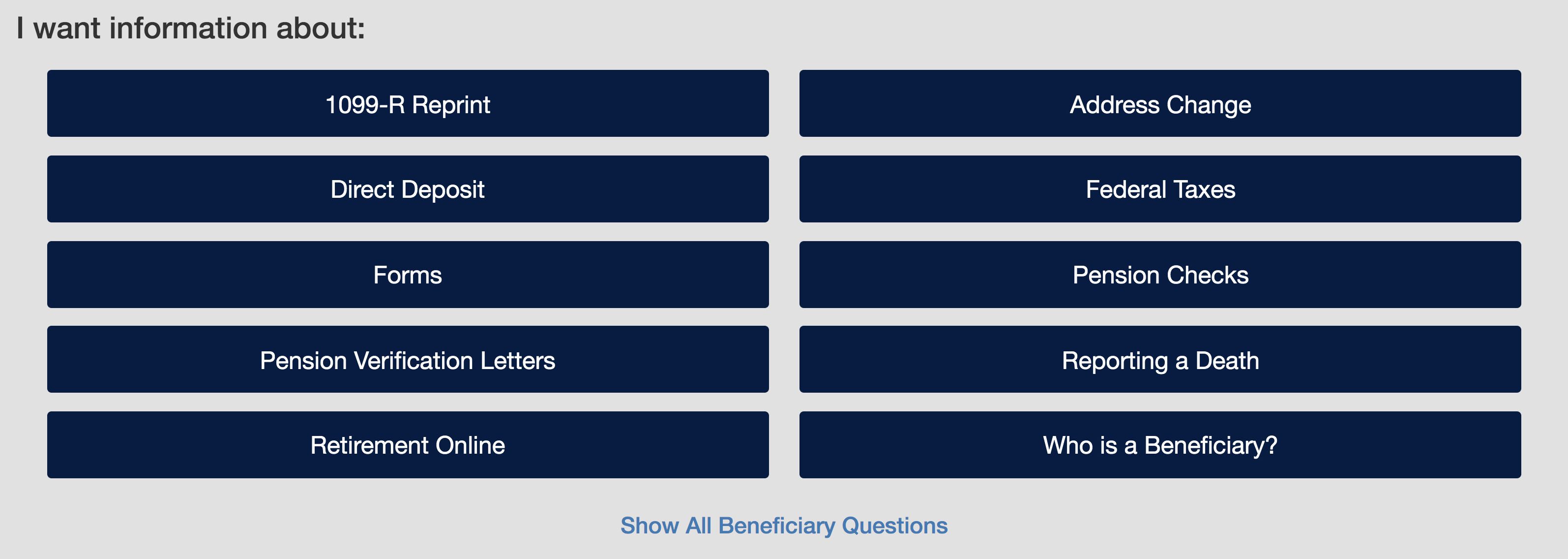

A look back at membership growth through the years.

NYSLRS: Retirement Security Before Social Security

Before NYSLRS began in 1921, many New York public employees who were no longer able to work would fall into poverty. At the time, Social Security didn’t exist to help supplement post-retirement income. While Social Security was created in 1935, it wasn’t made available to public employees until 1950 and didn’t start in New York until 1953.

NYSLRS in 1950

Under State Comptroller Frank C. Moore, NYSLRS was comprised of 161,686 participants in 1950. Of those, 151,326 were Employees’ Retirement System (ERS) members and 10,360 were retirees and beneficiaries.

You may have noticed that there were no Police and Fire Retirement System (PFRS) members in 1950. We had police and fire members – a little more than 12,000, in fact – but they were considered ERS members until 1967. On April 1, 1967, ERS split into the two systems you know today: ERS and PFRS.

NYSLRS in 1970

Participation in NYSLRS grew to 525,763 in 1970. Of these, 463,939 were members and 51,824 were retirees and beneficiaries. The State Comptroller at the time was Arthur Levitt Sr. Comptroller Levitt is known for having the longest tenure as State Comptroller, serving a total of 24 years from 1955 to 1978.

The 1970s also saw the creation of a new member group. Tier 2 began on July 1, 1973. The creation of Tier 2, and the other tiers that followed, were designed to provide members equitable benefits at a reasonable cost.

NYSLRS in 1990

From 1979 to 1993, Edward V. “Ned” Regan served as State Comptroller. During his time in office, participation in NYSLRS continued to climb, growing to 882,410 in 1990. Of these, 649,847 were members and 232,563 were retirees and beneficiaries.

NYSLRS in 2010

Between 2006 and 2007, participation in NYSLRS broke the one-million-participant mark. In 2010, during current Comptroller Thomas P. DiNapoli’s administration, participation rose to 1,055,020. Of these, 679,217 were members and 375,803 were retirees and beneficiaries.

NYSLRS in 2015

In 2015, overall membership in the System reached 1,073,486. This includes 643,178 members and 430,308 retirees and beneficiaries (the most recent data available). The number of retirees is increasing more quickly than members. For example, in 1995, retirees represented 30 percent of the System’s members. By 2015, that number had increased to approximately 40 percent.

What does 2016 hold for NYSLRS? Keep an eye out in future blog posts for the latest NYSLRS demographics.