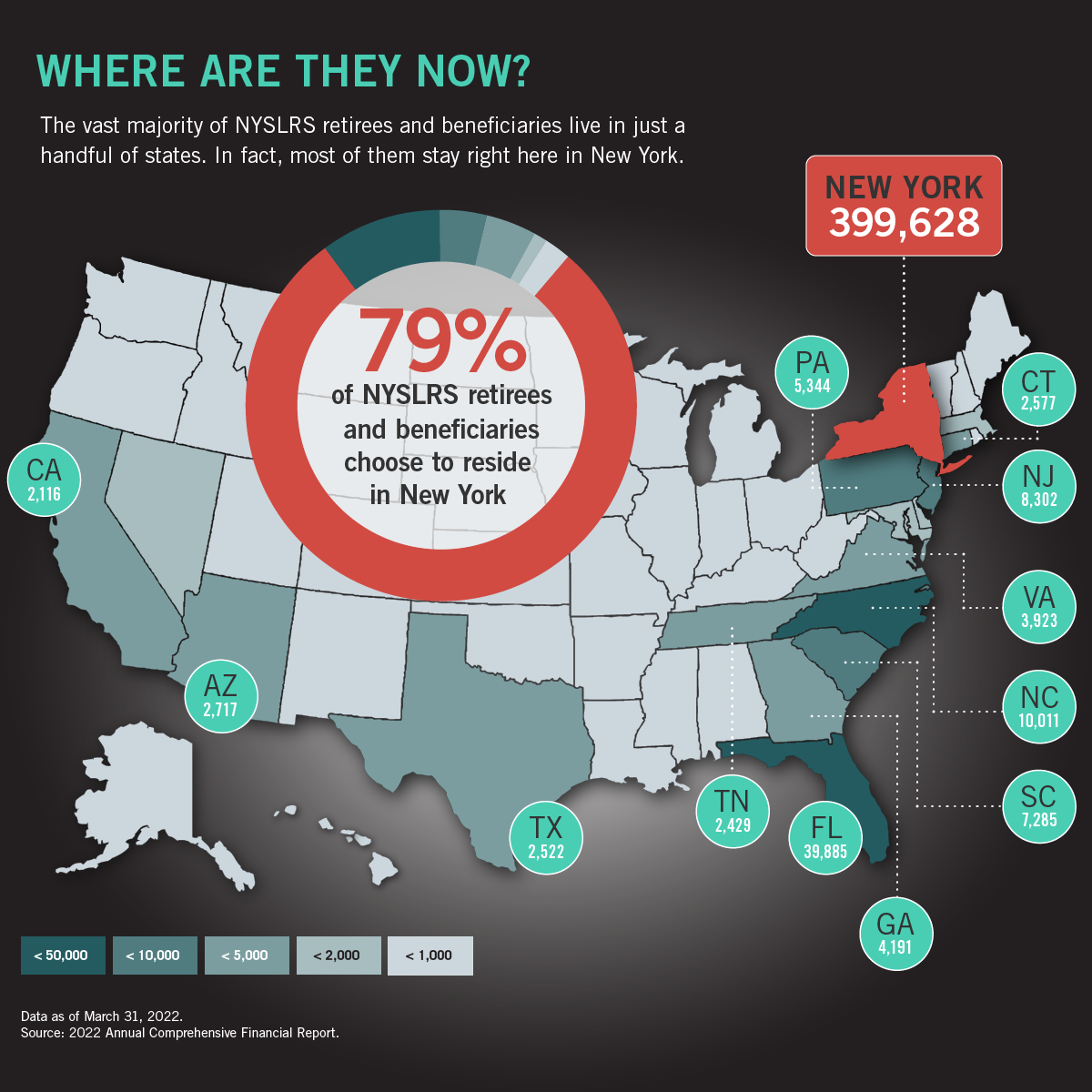

NYSLRS was providing pension benefits to 507,923 retirees and beneficiaries as of March 31, 2022.

Nearly 79 percent of NYSLRS retirees and beneficiaries — some 399,628 — live right here in New York State, and they can be found in every region and county. The Capital District, for instance, is home to more than 64,000 retirees and beneficiaries, with roughly the same number living on Long Island.

These New York retirees live in our communities, and their pension money flows right back into our neighborhoods. Retirees in New York pay local property and sales taxes, and their spending supports local businesses, stimulates the economy and generates thousands of jobs.

NYSLRS Retirees in the United States

NYSLRS retirees can also be found in every state. Florida, not surprisingly, is the number two choice after New York, with nearly 39,885 calling the Sunshine State home. North Carolina is third, with 10,011 retirees, followed by New Jersey, with 8,302. North Dakota has the fewest, with only 20 retirees and beneficiaries. Another 646 live outside the United States.

Learn More

Extensive information about our retirees and members, the Common Retirement Fund and Fund investments can be found in our latest Annual Comprehensive Financial Report. This report, published each fall, has a wealth of information about the Retirement System, its investments, strategies and financial position. It also provides details about NYSLRS’ nearly 1.2 million members, retirees and beneficiaries.

I have now been retired for 2 years and still have not received my final recalculation including vacation time additions etc,, and the back pay owed under that recalculation. 2 years ! Is NYSLRS making any effort to catch up on these recalculations and payments? What year are they up to ?

Virtually all initial pension payments are made timely by the end of the month following retirement. These payments are closer than ever to a retiree’s final calculation. NYSLRS often receives adjustments to earnings for retirees well after the date of retirement and is working hard to recalculate pension amounts and provide retroactive payments as quickly as possible. We apologize for the length of time this has taken for some retirees. Thank you for your patience.

it’s best to move to a state where there is no incomes tax, Texas, Nevada, South Dakota….your pension money goes a lot further in states like that.

Your NYSLRS pension is not subject to State or local income taxes in New York, but it may be taxed if you move to another state. To find out which states tax pension benefits, visit the Retired Public Employees Association website.

The online portal needs to be 24/7 and let us be able to manage our account without having to phone in all the time to make changes.

Retirement Online’s current regular hours of availability, which were expanded recently, are:

Mon, Wed & Fri: 7:00 am to 10:00 pm EST/EDT

Tue & Thu: 7:00 am to 6:00 pm EST/EDT

Sat & Sun: 6:00 am to 11:00 pm EST/EDT

Over time, hours of availability will continue to be expanded. You can visit our Retirement Online sign in page for the latest online availability information.

I retired over a year ago and haven’t gotten my reimbursement. I can’t get through to anyone. They keep saying to go to this site and there’s no information on it. They owe me over $4,000 so far.

Your message is important to us, and we have sent you a private message in response.

Love NY/NYC – Born and Bred – but rampant crime, skyrocketing taxes, Unmanaged homelessness, unfettered illegal immigration, Government Programs and Services given to illegals, filth and graffiti, why stay?

Look at the numbers a different way – 21% of Retirees are leaving the state!

That’s a loss of votes, tax revenue, investments and purchasing power!

Bad for New York, good for other states!!!

The vast majority 89% choose to live in New York l. That is a large percentage. Most of us are very grateful for the opportunity we had to live and work in NYS and for our pension. Thank you NYS. I ❤️ love New York.

You are correct… but taxes ARE too high: sales tax, property tax, as well as very high cost of real estate, utilities, services, etc.

I would have to keep working full time to be able to afford NY.

By leaving NY I can live well on my pension, as well as enjoy the sunny weather ( in north Florida ) , great for outdoor activities, gardening, etc. Sales tax here is 6.5%, no income tax, much lower propert tax ( i pay $ 8600 LESS per year here than NY). Add it all up every year recurring…. huge cost savings, pays for my boat, etc.

I love NY…born & bred…but the crime rate has skyrocketed along with taxes and long range goals being instituted in a super short time period that is causing our demise…..if the grandkids move we will probably follow .

God bless the New York State pension system.

How do you get through to a human being? I’ve been trying to get my reimbursement for over a year and I haven’t seen a penny.

Your message is important to us, and we have sent you a private message in response.

How many NY retirees, live in Hawaii ?

As of March 31, 2022, there were 115 NYSLRS retirees and beneficiaries living in Hawaii. You can find more information about where NYSLRS retirees reside on pages 32 and 33 of the 2022 NYSLRS Annual Comprehensive Financial Report.

Thank you. I and my former co-workers who retired and who I keep in touch with love the NYS Pension! When I call the 1-866-805-0990 retiree number I get fast and efficient answers to my pension questions.

Happy and Healthy 2022 to all NYS Pension workers and retirees!

I am a NYSLR for a year presently living in Geogia, USA. Do you have retirees that have moved to this state?

As of March 31, 2022, there were 4,191 NYSLRS retirees and beneficiaries living in Georgia. You can find more information about where NYSLRS retirees reside on pages 32 and 33 of the 2022 NYSLRS Annual Comprehensive Financial Report.

I love New York and my pension but I’ve got a 135 minute wait!!!! Not fast. The retirement online is great but I have another question need to talk to them.

Your message is important to us, and we have sent you a private message in response.