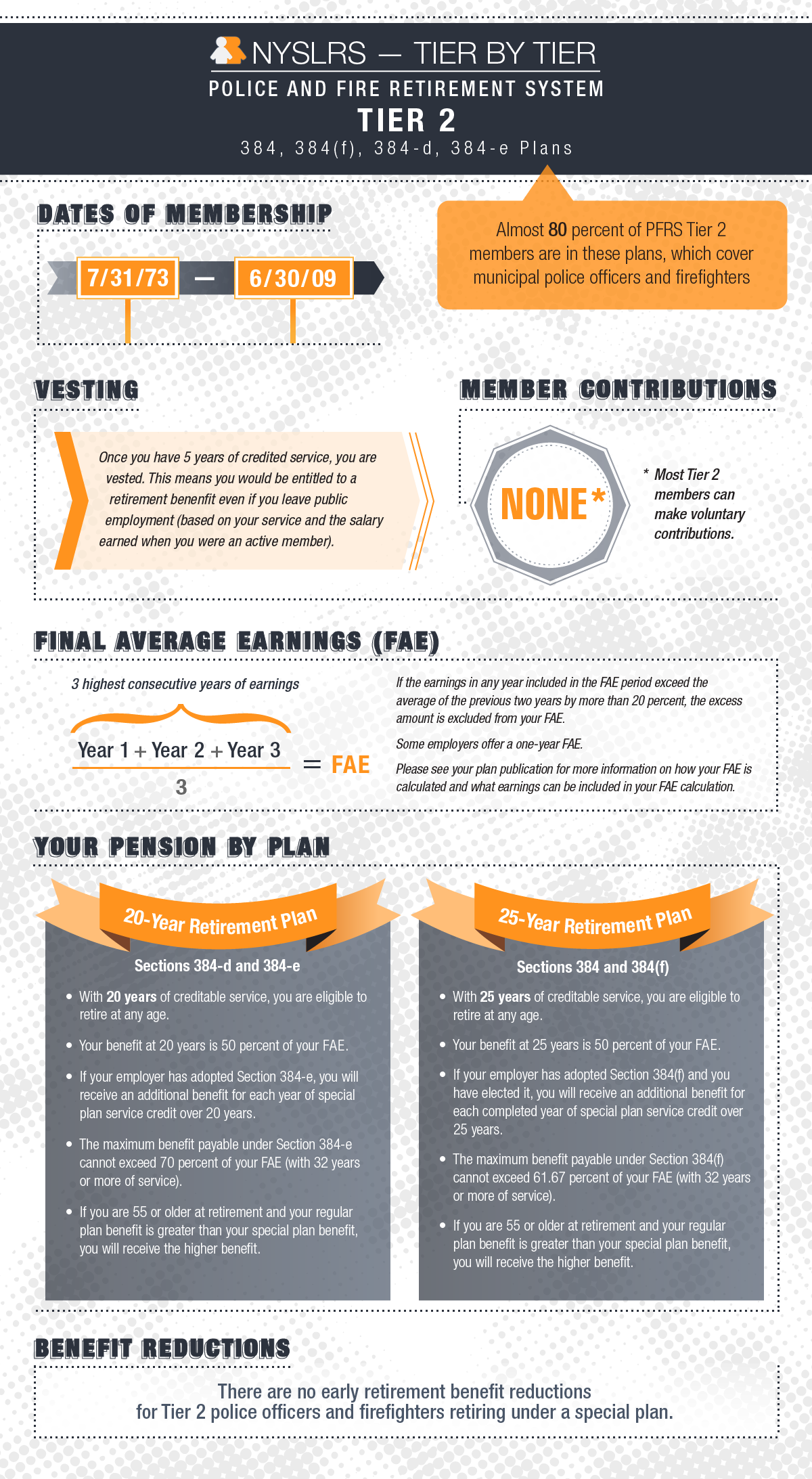

When you join the New York State and Local Retirement System (NYSLRS), you’re assigned a tier based on the date of your membership. This post looks at Tier 2 members of the Police and Fire Retirement System (PFRS).

Your tier determines such things as your eligibility for benefits, the calculation of those benefits, death benefit coverage and whether you need to contribute toward your benefits.

PFRS has five tiers. Almost half of PFRS members are in Tier 2, which began on July 31, 1973, and ended on June 30, 2009. Most are in special retirement plans that allow for retirement after 20 or 25 years, regardless of age, without penalty.

The special plans that cover most police officers and firefighters fall under Sections 384, 384(f), 384-d, and 384-e of Retirement and Social Security Law. You can sign in to Retirement Online to find your benefit plan, which is listed under ‘My Account Summary.’

Where to Find PFRS Tier 2 Information

Whether you’re in one of the retirement plans described in this post or another retirement plan, we encourage you to visit our website to find your NYSLRS retirement plan publication. It’s a comprehensive description of the benefits you’re entitled to receive as a PFRS member.

You can check your service credit total and estimate your pension using Retirement Online. Most members can use our online pension calculator to create an estimate based on the salary and service information NYSLRS has on file for them. You can enter different retirement dates to see how your choices would affect your potential benefit.

Members may not be able to use the Retirement Online calculator in certain circumstances, for example, if they have recently transferred a membership to NYSLRS, if they are a Tier 6 member with between five and ten years of service, or if they have worked for multiple employers and were covered by different retirement plans. These members can contact us to request an estimate or use the “Quick Calculator” on our website. The Quick Calculator generates estimates based on information you provide.

Is there a formula for the extra contributions /annuity one can make ,is age a factor in the payout ?

For answers to your questions, please email our customer service representatives using the secure form on our website. One of our representatives will review your account and respond to your questions. Filling out the secure form allows us to safely contact you about your personal account information.

Can this all change if Cuomo gets a constitutional convention after the vote this November?

The New York State Constitution protects your NYSLRS pension benefit from being diminished or impaired. Your pension can only be reduced if the Constitution is amended, and one way to do that is through a constitutional convention.

Every 20 years, a question appears on the ballot asking voters if there should be a convention to revise and amend the constitution. This question will be on the November 7, 2017 general election ballot. If voters approve the convention, delegates would be elected the following November and the convention would begin in April 2019. Any constitutional changes proposed by the delegates must be approved by the voters in the following general election.

Although there’s no guarantee that a convention would result in changes to public pension benefits, your pension, along with other protections provided by the constitution, could possibly be affected. That is one of several reasons why Comptroller Thomas P. DiNapoli is opposed to the constitutional convention.

Guess those of us stuck by our employers and the legislature and governor in one of the non-special plans are barely worthy of a footnote. Yipee.

Although this week’s post did not cover benefits for PFRS members in plans requiring a minimum retirement age, information about your plan is available on our website at http://www.osc.state.ny.us/retire/publications/index.php#pfrs-plans.

If you have specific questions about your benefits, our Contact Center can help. The email address is http://www.emailNYSLRS.com.