Your 2024 Member Annual Statement is a snapshot of your NYSLRS account as of March 31, the end of the State Fiscal Year. Statements are now available in Retirement Online.

Members who opted to go paperless already received an email notifying them their Statement is available in their Retirement Online account. If you did not change your delivery preference to email, your Statement will be mailed to you by the end of June.

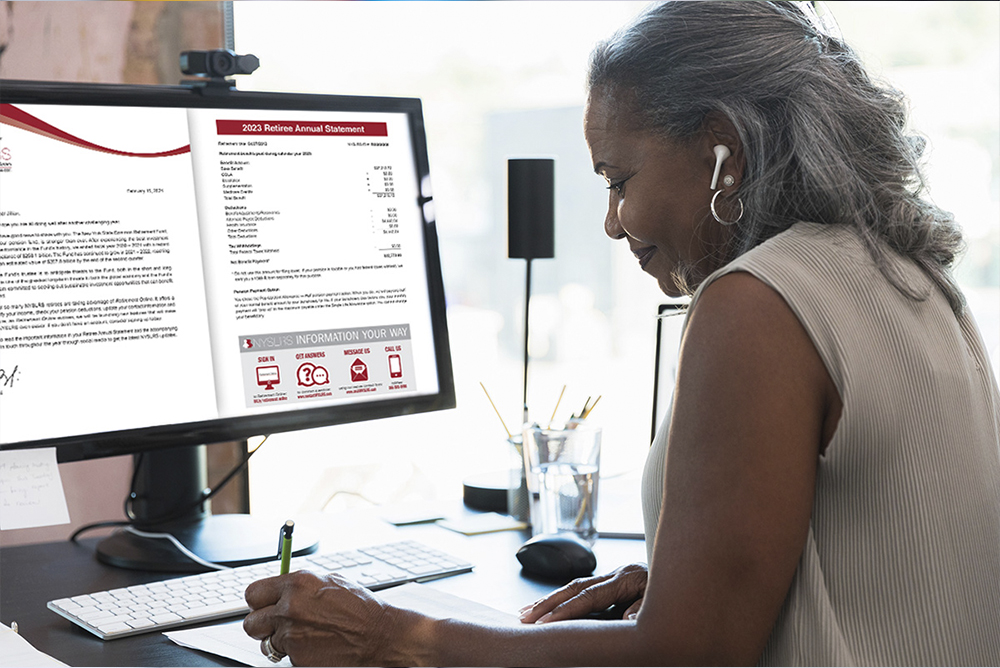

Reminder for retirees: Retiree Annual Statements were sent in February and are available online.

Access Your Member Annual Statement

Whether you chose email delivery or not, you can access your Statement in your Retirement Online account now.

- Sign in to Retirement Online.

- Click the “View My Member Annual Statement” button.

- Follow the prompts.

Review your Statement carefully to make sure it’s correct.

You can use Retirement Online to:

- Update your contact information.

- Change your last name.

- Manage your beneficiaries and update their contact information.

Visit our Member Annual Statement page if you have questions or need to correct other information in your Statement, such as the earnings reported to us by your employer or your date of birth.

Next Year Don’t Wait for the Mail

Your Statement becomes available online in early May each year. Get yours faster and help us ‘go green’ — update your delivery preference now to receive an email as soon as next year’s Member Annual Statement is available online, instead of waiting to receive it in the mail.

- Sign in to Retirement Online.

- Click “update” next to ‘Member Annual Statement by.’

- Choose “email” from dropdown.

Sign in to Retirement Online for Up-to-Date Information

For the most up-to-date information year-round, sign in to Retirement Online. If you don’t already have an account, you can learn more or register today.

- Estimate Your Pension Benefit. Your Statement may include one or more projections of your monthly retirement benefit. In Retirement Online, most members can create customized benefit estimates and calculate their pension payment options and enter different retirement dates and beneficiaries to see how your choices affect your potential benefit.

- Review Employment History and Service Credit. You can view your recent employment history, reported earnings for the past five years and current total estimated service credit in Retirement Online. If you think you may be eligible for past service that’s not included in your employment history, you can request to purchase that service credit. Make sure to buy past service credit as soon as possible.

- Manage Loan Balances or Apply for a Loan. Check Retirement Online for your current loan balance on any existing loans and manage your loan payments. It’s also the fastest and easiest way to apply for a loan with NYSLRS. You can see how much you are eligible to borrow, what the repayment amount would be and if your loan will be taxable.

If you need help with Retirement Online, read our Retirement Online Tools and Tips blog post.