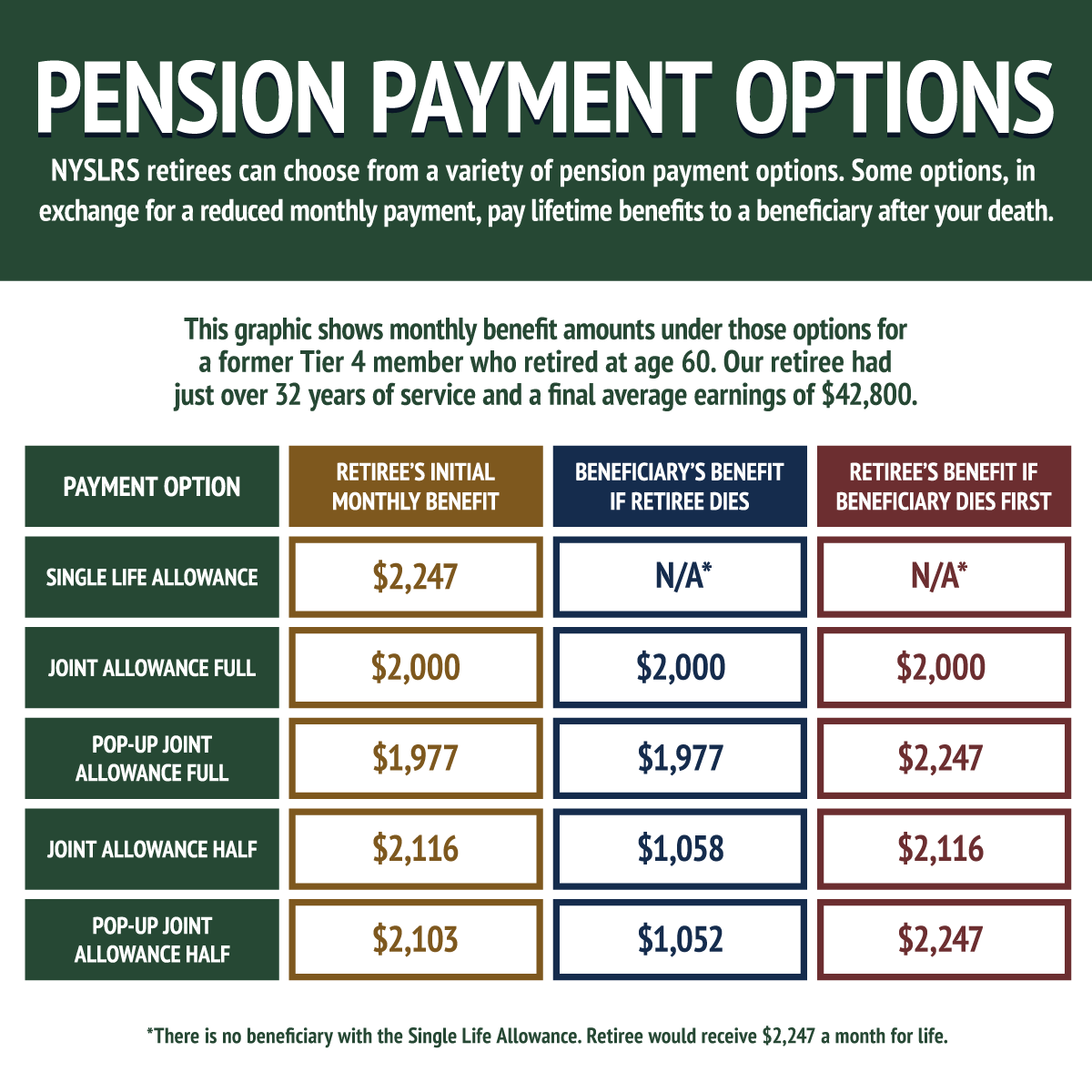

When you apply for a NYSLRS pension, you’ll need to choose a payment option, which determines how your retirement benefit will be paid. All options will provide you with a monthly benefit for the rest of your life. The single life allowance option pays the highest monthly benefit, but all payments stop at your death. If you choose a different option, you may be able to provide a lifetime benefit to a beneficiary.

You can apply for service retirement through Retirement Online. One of the benefits of applying online is that you’ll see a projection of your pension payment under each option before you’re asked to select one. If you submit your retirement application by mail, you’ll need to mail a paper option election form.

Joint Allowance Payment Options

In exchange for a reduction in your monthly payment, joint allowance options pay your beneficiary all or part of your pension after you die. The amount of the reduction in your pension is based on your life expectancy and the life expectancy of your beneficiary. The reduction is permanent even if your beneficiary dies before you do.

You can only choose one beneficiary under a joint allowance option, and you can’t change your beneficiary after you retire, regardless of the circumstances. If your beneficiary dies before you, all payments will stop when you die.

Pop-Up Payment Options

Like joint allowance options, pop-up options allow you to provide a lifetime payment for a beneficiary after your death. But, if your beneficiary dies before you, your future monthly payments will increase to the amount you would have been receiving had you chosen the single life allowance at retirement. (The pop-up only affects future payments. You would not be entitled to any retroactive payments.)

The monthly reduction in your benefit will be greater if you choose a pop-up option over a regular joint allowance.

Payment Options for Multiple Beneficiaries

There are options that allow you to leave a monthly payment to more than one beneficiary, and options that leave a benefit for a certain amount of time. For more information, visit our Payment Option Descriptions page.

Consider Your Decision Carefully

There are many factors that might influence your payment option choice. Your age and overall health, the age and health of your partner, and your loved one’s access to other financial resources should all be considered.

You only have 30 days after the last day of your retirement month to change your option. After that date, you cannot change your option for any reason.

An important step in retirement planning is finding out how much you can expect to receive. Most members can use Retirement Online to create a pension estimate based on the salary and service information we have on file for them. You can enter different retirement dates and beneficiaries to see how they affect your potential benefit and pension payment options. Go to the ‘My Account Summary’ section of your Retirement Online Account Homepage and click the “Estimate my Pension Benefit” button. You can also ask NYSLRS to send you a benefit estimate that calculates your pension under the various options.

Other Death Benefits

Most NYSLRS retirees are eligible for a post-retirement death benefit if they retire directly from payroll or within one year of leaving covered employment. Eligibility depends on your retirement plan and tier. If you are eligible, your beneficiary will receive a one-time, lump sum payment. The amount of the post-retirement benefit is a percentage of the death benefit available during your working years. For information about this and other potential death benefits, please visit our Death Benefits for Retirees page.

I am 73 and worked this past year for just one year and am no longer employed. I would like to withdraw my member contribution. Please advise what I need to do. Thanks.

To withdraw your membership, sign in to your Retirement Online account, go to the ‘My Account Summary’ area of your Account Homepage and click “Withdraw My Membership.” You can also apply by mail by submitting a Withdrawal Application (RS5014).

You may find our booklet What if I Leave Public Employment? helpful.

If you have questions, please message our customer service representatives using our secure contact form. Filling out the secure form allows them to safely contact you about your personal account information.

Hi,

How I know if I qualify to withdrawal all my benefit in one lump sum payment and, how I can get the estimate? I going to be 59 in September and my beneficiary is 63

If you have already left public employment, or plan to leave, your options will depend on how many years of service you have. You can find more information in our blog post Know Your Benefits: What If I Leave Public Employment.

If you are eligible for a NYSLRS pension, you can use the benefit calculator in Retirement Online to estimate your retirement benefit based on information we have on file for them.

For account-specific information about your situation, please message our customer service representatives using our secure contact form. Filling out the secure form allows them to safely contact you about your personal account information.

What’s the difference between retiring at 61 and 62? will it really affect me?

How your pension will be calculated depends on your tier and retirement plan.

For most members, if you retire before your full retirement age, you’ll have a reduction for early retirement.

Benefit reductions are prorated by month. The closer you are to your full retirement age at retirement, the less the reduction will be. It’s important to know that once you retire with a reduced benefit, the reduction is permanent.

Most Tier members can use Retirement Online to create NYSLRS pension estimates based on the salary and service information we have on file for you. You can enter different retirement dates (such as retiring at 61 versus 62) to see how they affect your potential benefit.

To create an estimate, sign in to Retirement Online. From your Account Homepage, go to the ‘My Account Summary’ section and click the “Estimate my Pension Benefit” button.

What percentage of my pension would I receive if I retire at the age of 54 with 20 year in Tier 2 Police and Fire and with 3 year of buy back time for my military service?

Most members can use Retirement Online to estimate their pensions based on salary and service information we have on file for them. You can create your own pension estimate by signing in to Retirement Online. From your Account Homepage, go to the ‘My Account Summary’ section and click the “Estimate my Pension Benefit” button. You can adjust the service credit in your estimate if you plan on purchasing your past military service.

I would like to retire on June 30 which falls on a Sunday. My work schedule is Mon – Fri. Which day do I need to put down on my retirement paperwork? The 28th or can I use the 30th? I’ve heard it’s better to leave at the end of the month vs. the beginning.

Thanks

Your retirement date is up to you, however, your NYSLRS retirement date is your first day of retirement, not your last day of work. For example, if you planned to work on June 28, you would not use that day as your retirement date.

To start receiving your pension, you must apply with NYSLRS 15 to 90 days before your retirement date. Retirement Online is the fast and convenient way to apply for a NYSLRS service retirement benefit.

For account-specific questions, please message our customer service representatives using our secure contact form. Filling out the secure form allows them to safely contact you about your personal account information.

Can the date be a weekend date if that’s not your normal work day.

Yes, your retirement date can be a weekend. For example, if your last day of work is Friday, June 28, you could choose Saturday, June 29, as your retirement date.

Will I have access to NYSLS after I retire?

Yes, after you retire, you will have access to Retirement Online and other NYSLRS services.

Retirement Online is a secure way to manage your benefits online. As a retiree, you will be able to manage your direct deposit information, update your federal tax withholding and view your pension payment information. Retirees can also update their contact information, generate an income verification letter and update death benefit beneficiaries online.

You can find more information in our blog post Retirement Online for Retirees Just Got Better.

What percentage would I get as a ny

state correction officer with 39 years at age 62?

Your retirement calculation depends on your tier and retirement plan.

Most members can create pension estimates based on the account information we have on file for you using Retirement Online. You can enter different retirement dates to see how your choices would affect your benefit.

For specific information about your retirement plan, visit our Find Your NYSLRS Retirement Plan Publication page and follow the steps listed.

If you have questions, you can message our customer service representatives using our secure contact form. Filling out the secure form allows them to safely contact you about your personal account information.

The Wp withholding form is very confusing

In 2023, NYSLRS was required to update our federal tax withholding form (the IRS released a new version of their W-4P form). You don’t need to submit the new W-4P unless you want to change the amount of your tax withholding.

Our Taxes and Your Pension page provides information about withholding, including steps for completing the W-4P form.

The NYSLRS form was created based on the IRS version of the form, so if you need further assistance completing the NYSLRS form, you can visit the Internal Revenue Service (IRS) website and read the current revision of the IRS Form W-4P. Detailed instructions start on page 2. You can also find phone numbers and online resources on the IRS Let Us Help You page.

What happens to my spousal benefit under joint allowance full if I remarry?

A retirement option becomes irrevocable 30 days after the date the retirement benefit is payable. For options that provide a lifetime payment to a beneficiary (the Joint Allowance options), the beneficiary designation is also irrevocable after the 30-day period, even if the beneficiary remarries.

If you have account-specific questions, please email our Matrimonial Bureau.

If I have been out of the system for over 30 years am 57 and opt to withdraw how long does it take to receive the balance of the account

For general information about withdrawing your membership, check out our Life Changes: What If I Leave Public Employment? publication.

For current information about timeframes, please call our customer service representatives at 866-805-0990, press 2, then follow the prompts. You can also message them using our secure contact form. Filling out the secure form allows them to safely contact you about your personal account information.

How much does age affect your pension options? If I’m eligible to retire at 50 yo (and my spouse is 50), is a higher percentage taken out of my monthly payment than if we were 55 yo?

Depending on your retirement plan, most members can’t retire and collect a pension earlier than age 55.

Most Tier 2-6 members can now use Retirement Online to create a NYSLRS pension estimate based on the salary and service information we have on file for you. You can enter different retirement dates to see how your choices affect your potential benefit.

If you are unable to use the online calculator or if you have account-specific questions, you can email our customer service representatives using our secure contact form (http://www.emailNYSLRS.com) to request an estimate. Filling out the secure form allows them to safely contact you about your personal account information.

Can I get a lump sum now for hardship

If you are not yet retired, most NYSLRS members are allowed to take a loan from NYSLRS. Visit our Loans page for more information.

If you are talking about taking a lump sum payment at retirement, certain members are allowed to receive a partial lump sum (PLS) payment at retirement in exchange for a reduced monthly benefit.

If you are a Police and Fire Retirement System (PFRS) member covered by a plan that allows for retirement after 20 or 25 years of service regardless of age, you may be eligible for a PLS. Employees’ Retirement System (ERS) members must be employed as a sheriff, undersheriff, deputy sheriff or county correction officer and work for an employer that has chosen the PLS option.

You can find more information about the Partial Lump Sum (PLS) Payment option on our website.

if I have the single allowance before 10years and I get married can I add my wife ,aso if I have kids coming

Unfortunately, once you choose a retirement option, you have only 30 days after the end of your retirement month to change your option.

How can I receive a option election form?

You can find option elections forms and payment option descriptions on our website.

You may also be interested in How Do I Prepare to Retire? This booklet takes you step by step through the retirement process.