October is National Retirement Security Month, a time to learn more about the importance of saving and your potential sources of income in retirement. Even if your own retirement seems far off in the future, it’s never too early to start developing your plans for retirement.

NYSLRS and Retirement Security

Check out these blog posts to learn more about how your NYSLRS pension and other sources of retirement income can provide retirement security.

- What is a Defined Benefit Plan?

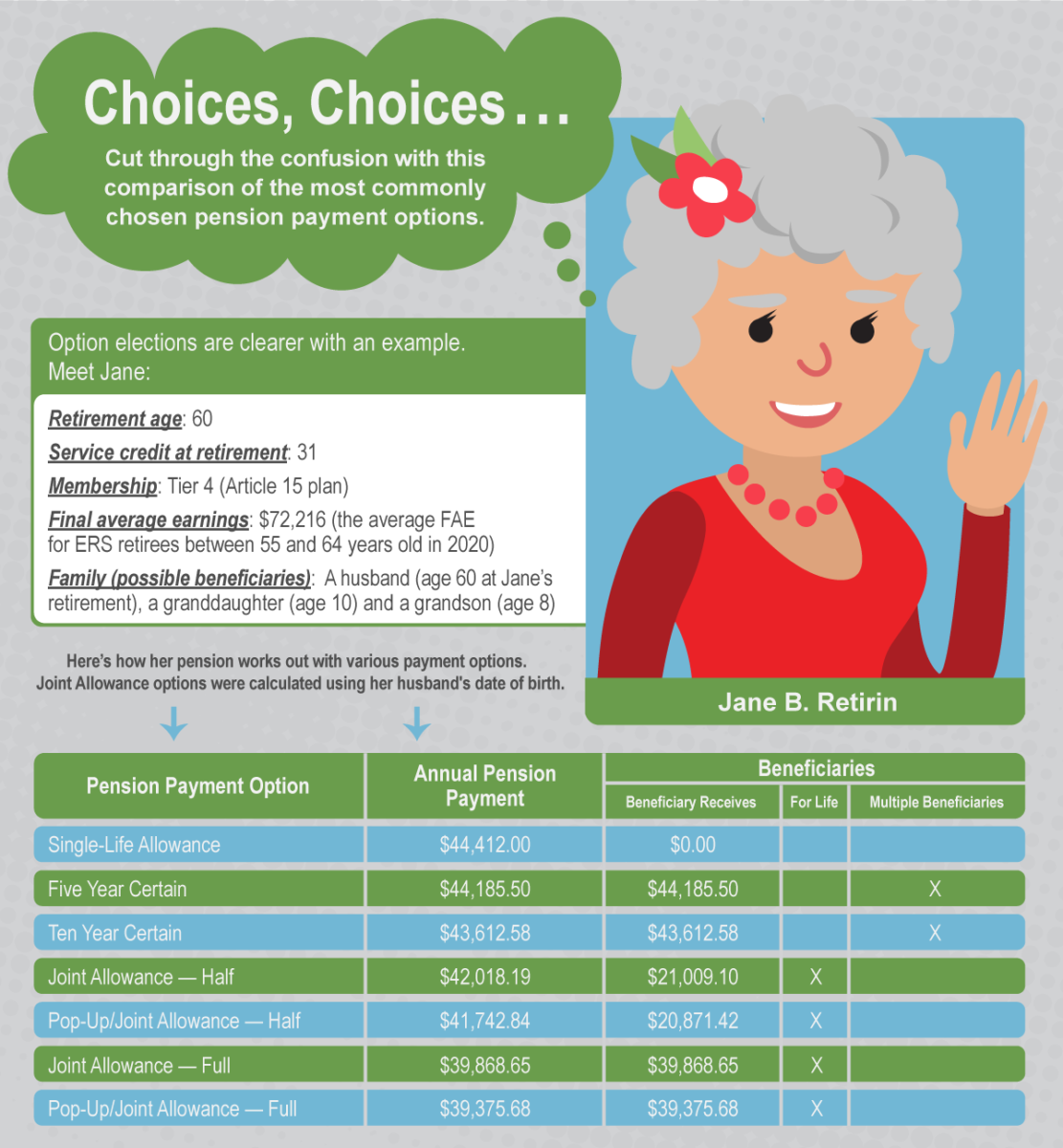

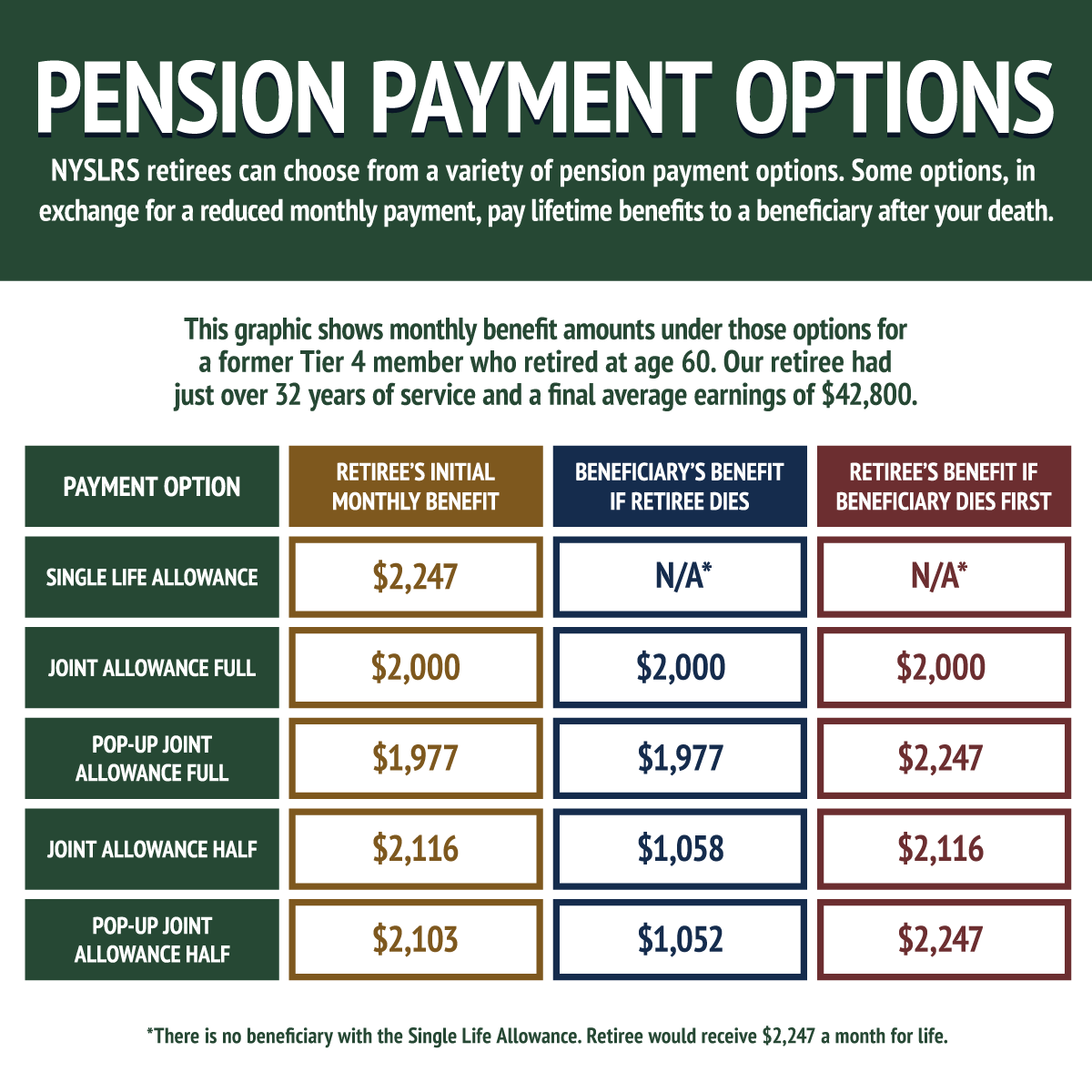

Your NYSLRS pension is a defined benefit retirement plan. When you retire, you’ll receive a guaranteed lifetime benefit based on your earnings and years of service. It will be calculated using a preset formula rather than being limited to your accumulated contributions and your investment returns, as it would be in a 401(k)-style plan. - The 3-Legged Stool: An Approach to Retirement Confidence

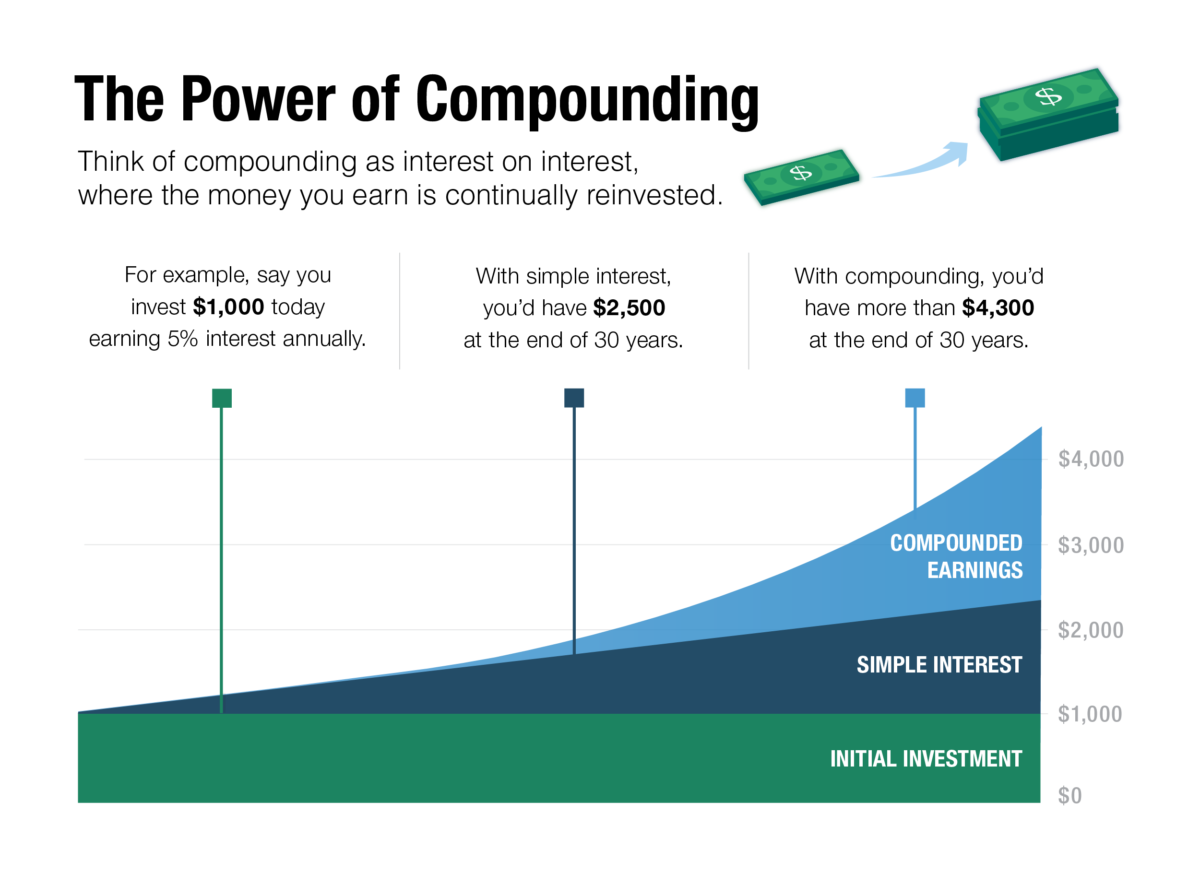

Think of your retirement security as a three-legged stool — each leg represents a different income source that supports you in retirement. The first leg of the stool is your NYSLRS pension, and the second leg is your Social Security benefit. The third leg is your own personal savings, which can give you more flexibility during retirement, helping to ensure that you’ll be able to do the things you want to do. - Compounding: A Great Way for Your Money to Grow

The sooner you can start saving, the better — especially if you have a retirement savings account with compounding interest. When your money is compounded, it increases in value by earning interest on both the principal and accumulated interest. But for your money to make more money, it needs time to grow. - Deferred Compensation: Another Source of Retirement Income

Deferred compensation plans are voluntary retirement savings plans. Your contributions will be automatically deducted from your paycheck, and you can contribute as little as 1 percent of your earnings. It’s a savings vehicle to consider if you want to start saving extra for retirement but aren’t sure where to start. - Give Your Retirement Savings a Boost

Once you’re on your way and saving for retirement, you may want to look at ways to increase how much you save. Even the smallest increase can make a big difference over time, while having a minimal impact on your take-home pay.

Remember, retirement security doesn’t just happen — it takes planning. Visit our Retirement Planning page for more information about your NYSLRS pension, including an overview of how it’s calculated, estimating your amount and how to find a description of the benefits provided by your specific retirement plan.

After months or years of retirement planning, you’re probably looking forward to the day when you

After months or years of retirement planning, you’re probably looking forward to the day when you