If you’re already building your retirement savings, you already understand how those savings, along with Social Security, work together with your pension to help provide financial stability in retirement. Financial advisors call this the “three-legged stool.”

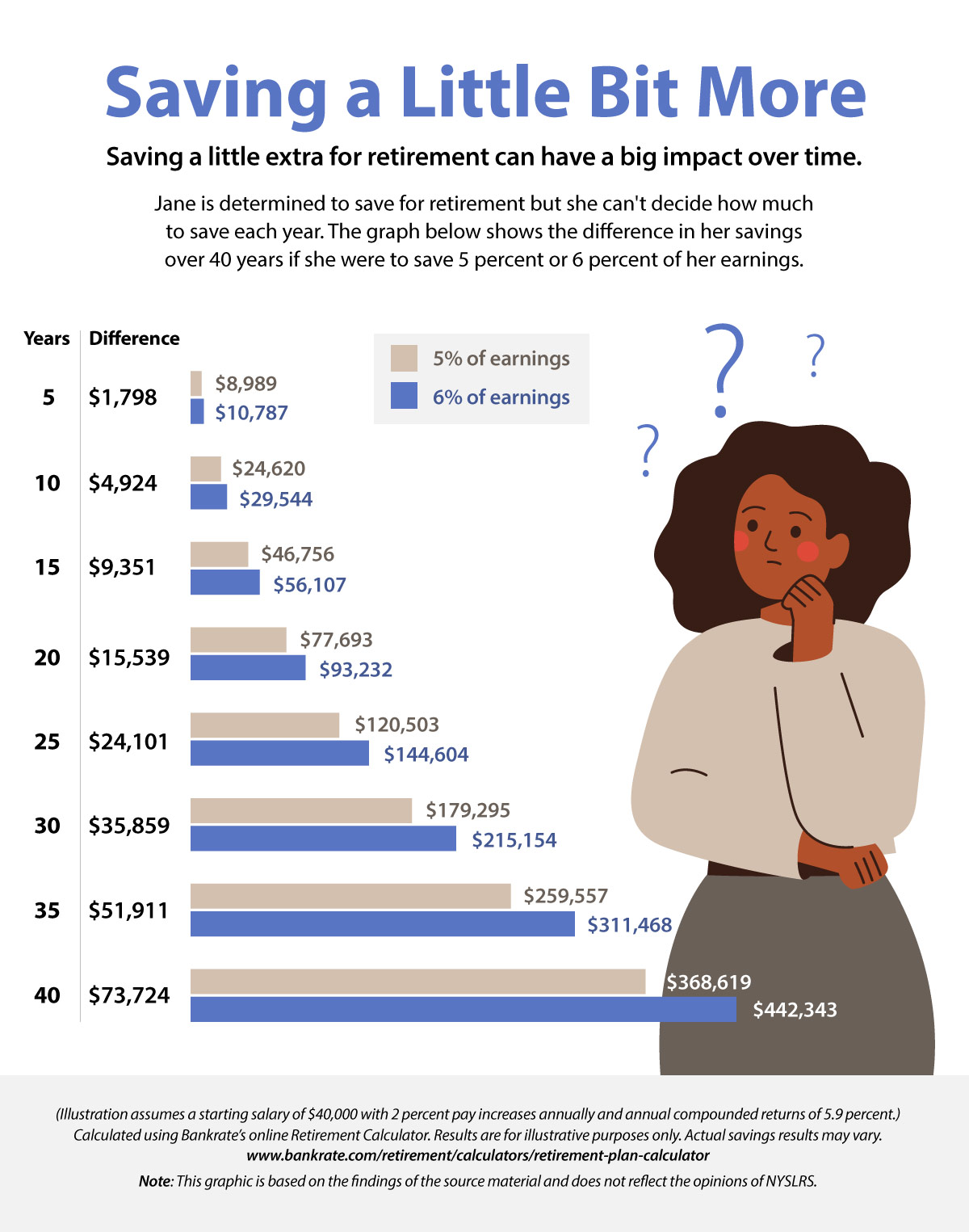

But why not take it a step further and give your retirement savings a boost? Even a small increase could make a big difference over time, while having minimal impact on your take-home pay.

How much of a difference would it make? You can check it out yourself using this online calculator and your own salary and savings information. Calculate the impact of your current savings, then try the same calculation with an additional 1 percent of your earnings. For example, if you’re saving 5 percent of your pay, see what saving 6 percent would do by the time you expect to retire.

Impact on Your Paycheck

Fortunately, adding a small amount to your retirement savings won’t have a substantial impact on your paycheck. For example, if you’re making $60,000 a year, 1 percent is only $600. That’s just $50 a month or, if you are paid every other week, about $23 per payday.

The impact on your take-home pay would be even less if you save in a tax-deferred plan because you won’t have to pay income tax on those earnings until after you retire. The New York State Deferred Compensation Plan’s paycheck impact calculator can help you estimate how increased savings would affect your paycheck. (You don’t have to have a Deferred Compensation account to use their calculator. The New York State Deferred Compensation Plan is not affiliated with NYSLRS.)

When to Increase Retirement Savings?

The sooner you boost your savings, the better off you’ll be. But if you’re not ready to increase your savings right now, then try this: Schedule your increase to coincide with your next raise. That way, you may not even miss the money.