NYSLRS pension payment options are designed to fit your needs after you retire. Understanding these options will make it easier for you to choose the one that’s right for you.

While the basic option, the Single Life Allowance, would provide you with a monthly payment for the rest of your life, all payments would end at your death. Other options, in exchange for a reduced benefit, allow you to provide for a spouse or other loved one after you’re gone.

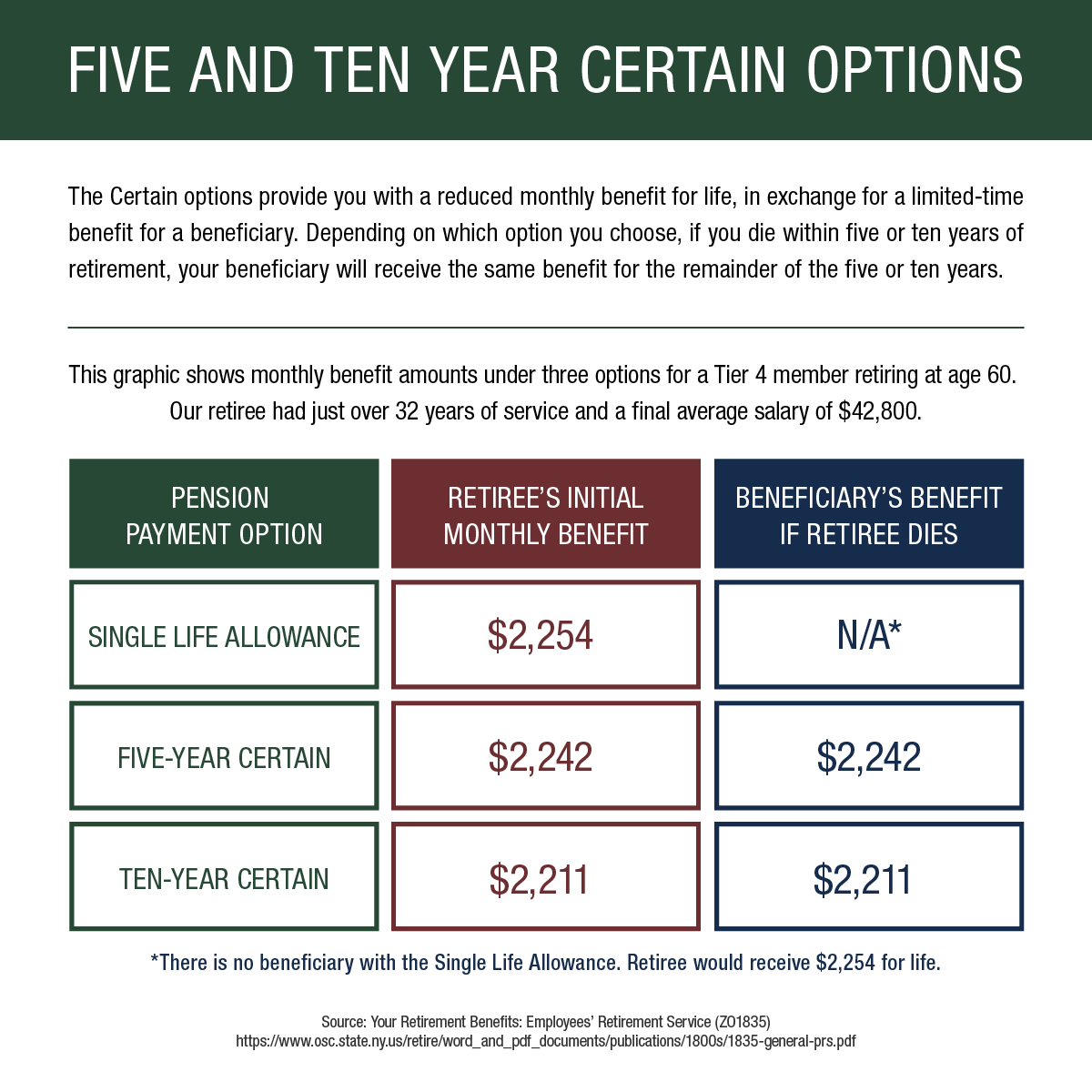

Five and Ten Year Certain options don’t provide a lifetime benefit for a beneficiary, but they have advantages you may want to consider.

How These Pension Payment Options Work

The Five Year Certain or Ten Year Certain options provide you with a reduced monthly benefit for your lifetime. If you die within the five- or ten-year period after your retirement, your beneficiary would receive pension payments for the remainder of the five or ten years. If you live beyond the five- or ten-year period, your beneficiary would not receive a pension benefit upon your death.

Let’s say you choose the Five Year option. If you die two years after retiring, your beneficiary will receive a benefit for three years. If you choose the Ten Year option, and die after two years, your beneficiary will get a benefit for eight years. In either case, your beneficiary would receive the same amount you were receiving, though they would not be eligible for any COLA increases.

Another feature of these plans is that you can change the beneficiary at any time within the five- or ten-year period.

Whatever your situation, you should review the payment options and choose carefully. Visit our Payment Option Descriptions page for details about all available pension payment options. For a better idea of how these payment options would work out for you and your beneficiary, try our online Benefit Calculator.