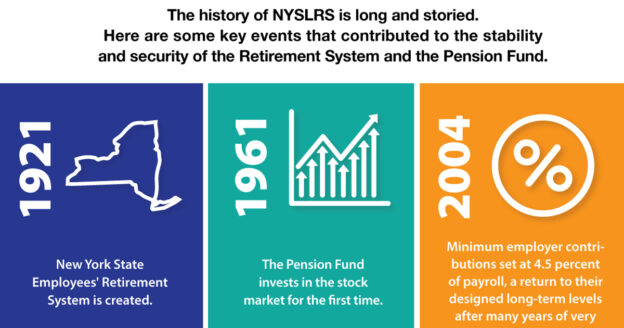

A century after its creation, the New York State and Local Retirement System (NYSLRS) is widely recognized as one of the best-managed and best-funded public pension systems in the nation. Comptroller DiNapoli recently announced that the New York State Common Retirement Fund (Fund), which holds and invests the assets of NYSLRS, had an estimated value of $268.3 billion as of June 30, 2021. The security and stability of NYSLRS and the Fund are due, in large part, to the stewardship of Comptroller DiNapoli, as well as a long line of State Comptrollers that came before him. The System has also been bolstered by some key events along the way.

In the Beginning

NYSLRS’ security and stability were built in at the start. In 1918, the State Legislature created the Commission on Pensions and charged it with recommending a pension system for State workers.

After surveying pension plans in New York and other states, the Pension Commission recognized the need to calculate the cost of the pension plan through actuarial calculations, which take into account such things as employees’ salaries and how long they are expected to be retired. They also saw the need to make provisions to cover those costs through contributions and other income. They recommended a plan supported by the contributions of employers (New York State and, eventually, local governments) and employees. The improved actuarial calculations the System uses today helps to ensure that member contributions and employer annual contributions are sufficient to keep the System adequately funded.

The Pension Commission also recommended a service retirement benefit be made available to workers who reached a certain age, based on average earnings and years of service. Though they didn’t use the term, their pension plan was very similar to the defined-benefit plan NYSLRS members have now.

Unlike the 401k-style defined-contribution plans common in the private sector today, a defined-benefit plan provides a guaranteed, lifetime benefit. With a defined-benefit plan, you don’t have to worry about your money running out during retirement, and your employer has an excellent tool for recruiting and retaining workers.

Constitutional Protection

In 1938, New York voters approved several amendments to the State Constitution, including Article 5, Section 7, which guarantees that a public pension benefit cannot be “diminished or impaired.” This constitutional language protects the interests of the Fund and its members and beneficiaries, ensuring that the money the Fund holds will be there to pay the pensions for all current and future retirees. The courts have upheld this constitutional provision to protect the Fund several times over the years.

For NYSLRS members and retirees, that means the retirement benefits you were promised when you started your public service career cannot be reduced or taken away.

Sound Investments

Sound investments are crucial to the health of the Fund, but in some cases changes in the law were needed to give Fund managers the flexibility to make the best investments. In 1961, the Fund was allowed to invest in the stock market, opening up the door for growth opportunities. Roughly half of the Fund’s assets are currently invested in stocks.

In 2005, the Legislature expanded the types of investments the Fund could make, allowing the Fund to increase investments in real estate, international stocks and other sectors that had been providing high returns.

Today, under Comptroller DiNapoli’s leadership, the Fund’s investment returns cover the majority of the cost of retirement benefits. After suffering a drop in value at the beginning of the COVID pandemic, the Fund had its best year in history, with estimated investment returns of 33.55 percent for fiscal year 2021.

NYSLRS is well-positioned to face the challenges of the future and provide retirement security for more than 1.1 million members, retirees and beneficiaries.

“A century after its creation, the New York State and Local Retirement System (NYSLRS) is widely recognized as one of the best-managed and best-funded public pension systems in the nation.”

This is the first sentence at the top of this article. So how come I have been waiting over 7 months for the retirement system to update my final FAS, when i was able to correctly calculate it using the on-line calculator 3 weeks prior to my retirement…and when calling in to see what the delay is…I am advised that it will take an additional 1 year for them to get my calculation corrected…a monthly difference representing about $260.00 monthly shortage (significant to me).

Given these stats, I wouldn’t necessarily make a statement such that our pension system is one of the “best managed pension systems in the nation”.

Keep up the good work mr denapoli.

On behalf of Comptroller DiNapoli, thank you for your kind words. They are greatly appreciated.

Since I retired in 2003, inflation has increased over 45%. The Dow Jones has increased over 300%. My pension has increased less than 5%. When will Comptroller DiNapoli, recommend an increase in the base amount that the pension “diet Cola” is calculated? It has never been increased from $18,000.

Retirement benefits, including COLA, are established by law. The decision on whether to enact new laws comes from the State Legislature and the Governor.

The State Legislature would need to pass a bill and the Governor would need to sign it into law in order to increase the $18,000 COLA calculation amount. You may want to contact your local legislative representatives.

This is your typical absurd answer; I know that Comptroller DiNapoli can introduce bills to the Legislature to fix the COLA problems. He is bragging that he has so much of our money, but our money isn’t helping us the way is should. I remember a case in the 1980s where a man who retired in the 1940s and his wife committed suicide because the pension they were living on did not provide them with what they needed to survive, never mind thrive!

https://www.bls.gov/data/inflation_calculator.htm This is a link to the Bureau of Labor Statistics. You will be able to calculate how much inflation has increased since you retired.

Yet you do not address what I told you about how the Comptroller can introduce a bill in his yearly legislative program to increase the Cola to where pensioners keep up with inflation!!! If Edward Smith works for the Comptroller he knows that I am Correct!

You make an excellent point!

You make an excellent and important point!

As the Comptroller has a Legislative Program whereby he sends bills to the Legislature on a yearly basis, why doesn’t the Comptroller write a Bill and and a Memorandum In Support to take increase the $18,000 amount subject to one half the inflation rate. I know that Retired Public Employees Association (RPEA) has tried in the past and failed to secure passage of such a bill. You would almost certainly gain the support of RPEA.

On behalf of the thousands of NYS Retirees I want to Thank You Comptroller DiNapoli and Your Staff for the Great work You have done to strenghten and preserve The NYS Retirement Fund. Keep up Your fine work and God Bless You”.

We’re sure Comptroller DiNapoli appreciates your feedback.

A estimated investment returns of 33.55 percent for fiscal year 2021? How did you achieve that during the first 6 months of this year? l’m pretty good and I only have somewhere between 11 to 15% for the year.

The estimated 33.55 percent investment return was for the State fiscal year that began on April 1, 2020, and ended on March 31, 2021. You can find information about the Fund’s investment philosophy and strategies on the New York State Common Retirement Fund page.

Comptroller DiNapoli has done a great job! Now for those in Unions (like myself) hired December 13, 2007. I was not advised of all the benefits – probably due to the fact that I started the week before Christmas 2007, so I was overlooked- in 2012, thinking I was working to build time -I found out that I lost all those work years and fell into the Tier 6 – when in fact I would have been in a Tier 4 or 5 the least!!!! Being part time – I am struggling now when people have retired, to work another 3 years towards a 10 year retirement!!!!!

This Tier issue needs to be addressed by NYSLRS and be fair to its members. I paid for time I brought – which still does not justify me being in a Tier 6 having worked for almost 13 years and getting credit for 7 –

There are no benefits for part time workers- not from the Union and not from Albany.

Benefits are: health insurance (looking out that all workers have health insurance – the least an organization can do to keep their workers in top health), and the pension plan – so these workers especially during Covid and after Covid, working in minimum hours allowed (replacing without equal pay -working out of Title) doing the jobs of full time retired workers with lifetime benefits and pension checks) are compensated justly.

This Tier mess needs to be corrected now!

Everyone’s voice needs to be heard and a solution needs to be faced.

The decision on whether to adopt benefit enhancements or pass new legislation comes from the State Legislature and the Governor. The retirement system (NYSLRS) administers legislation and programs that are signed into law. You may want to contact your local legislative representatives.

NYSLRS also doesn’t administer health insurance programs for its members or retirees. Whether you work for New York State or another public employer, your employer’s health benefits administrator (HBA) should be able to answer questions about available benefits.

If you have questions about your tier or earning service credit, please contact our customer service representatives for more information. You can call them at 866-805-0990 (518-474-7736 in the Albany, New York area), or email them using the secure email form on our website.

Thank you Mr. DiNapoli and God Bless you and your staff.

On behalf of Comptroller DiNapoli, thank you for your kind words. They are greatly appreciated.

need to change address

You can change your address using Retirement Online. If you don’t have an account, go to the Sign In page and click the “Sign Up” link under the “Customer Sign In” button.

Or, if your new address is a not a PO box or international address, you can update your address using our secure contact form. Complete all form fields and provide your old and new address.

You can also mail a completed change of address form to NYSLRS, 110 State Street, Albany, NY 12244-0001.