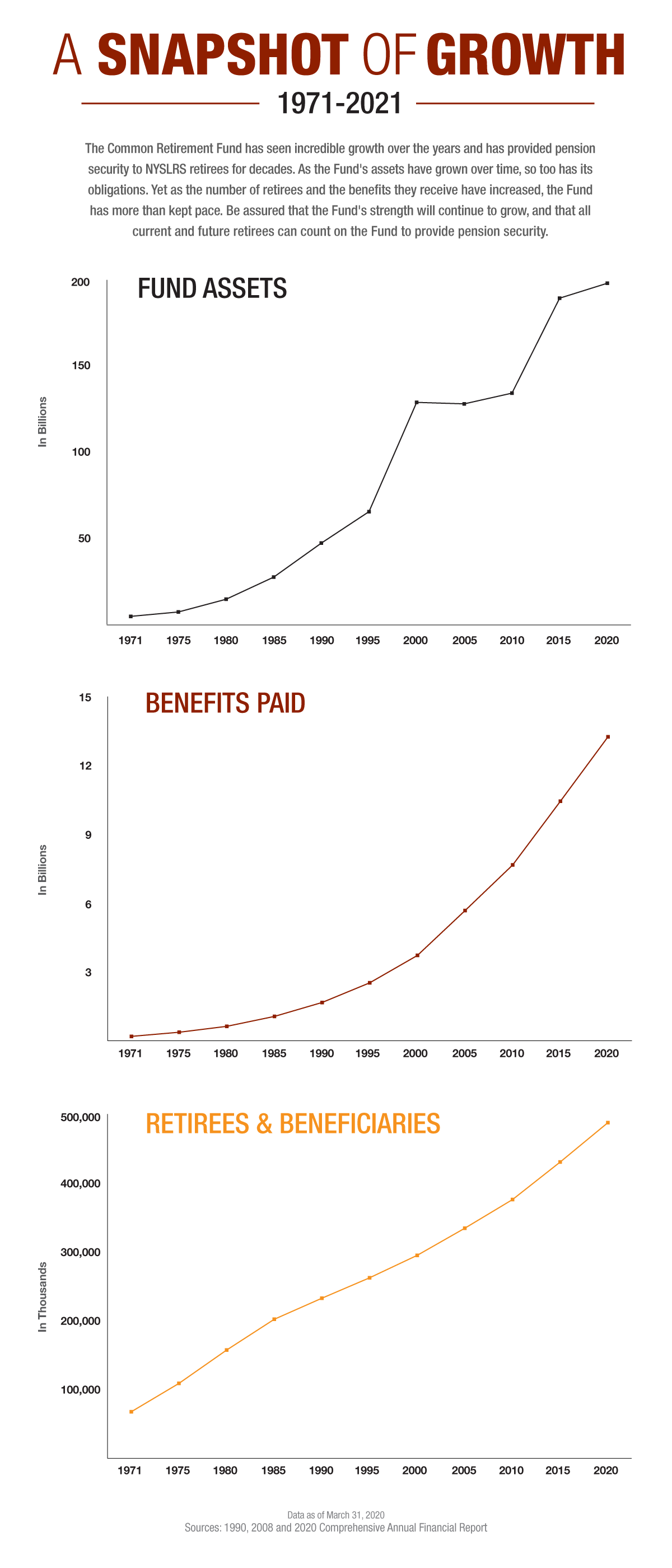

A century after its creation, the New York State and Local Retirement System (NYSLRS) is widely recognized as one of the best-managed and best-funded public pension systems in the nation. Comptroller DiNapoli recently announced that the New York State Common Retirement Fund (Fund), which holds and invests the assets of NYSLRS, had an estimated value of $268.3 billion as of June 30, 2021. The security and stability of NYSLRS and the Fund are due, in large part, to the stewardship of Comptroller DiNapoli, as well as a long line of State Comptrollers that came before him. The System has also been bolstered by some key events along the way.

In the Beginning

NYSLRS’ security and stability were built in at the start. In 1918, the State Legislature created the Commission on Pensions and charged it with recommending a pension system for State workers.

After surveying pension plans in New York and other states, the Pension Commission recognized the need to calculate the cost of the pension plan through actuarial calculations, which take into account such things as employees’ salaries and how long they are expected to be retired. They also saw the need to make provisions to cover those costs through contributions and other income. They recommended a plan supported by the contributions of employers (New York State and, eventually, local governments) and employees. The improved actuarial calculations the System uses today helps to ensure that member contributions and employer annual contributions are sufficient to keep the System adequately funded.

The Pension Commission also recommended a service retirement benefit be made available to workers who reached a certain age, based on average earnings and years of service. Though they didn’t use the term, their pension plan was very similar to the defined-benefit plan NYSLRS members have now.

Unlike the 401k-style defined-contribution plans common in the private sector today, a defined-benefit plan provides a guaranteed, lifetime benefit. With a defined-benefit plan, you don’t have to worry about your money running out during retirement, and your employer has an excellent tool for recruiting and retaining workers.

Constitutional Protection

In 1938, New York voters approved several amendments to the State Constitution, including Article 5, Section 7, which guarantees that a public pension benefit cannot be “diminished or impaired.” This constitutional language protects the interests of the Fund and its members and beneficiaries, ensuring that the money the Fund holds will be there to pay the pensions for all current and future retirees. The courts have upheld this constitutional provision to protect the Fund several times over the years.

For NYSLRS members and retirees, that means the retirement benefits you were promised when you started your public service career cannot be reduced or taken away.

Sound Investments

Sound investments are crucial to the health of the Fund, but in some cases changes in the law were needed to give Fund managers the flexibility to make the best investments. In 1961, the Fund was allowed to invest in the stock market, opening up the door for growth opportunities. Roughly half of the Fund’s assets are currently invested in stocks.

In 2005, the Legislature expanded the types of investments the Fund could make, allowing the Fund to increase investments in real estate, international stocks and other sectors that had been providing high returns.

Today, under Comptroller DiNapoli’s leadership, the Fund’s investment returns cover the majority of the cost of retirement benefits. After suffering a drop in value at the beginning of the COVID pandemic, the Fund had its best year in history, with estimated investment returns of 33.55 percent for fiscal year 2021.

NYSLRS is well-positioned to face the challenges of the future and provide retirement security for more than 1.1 million members, retirees and beneficiaries.