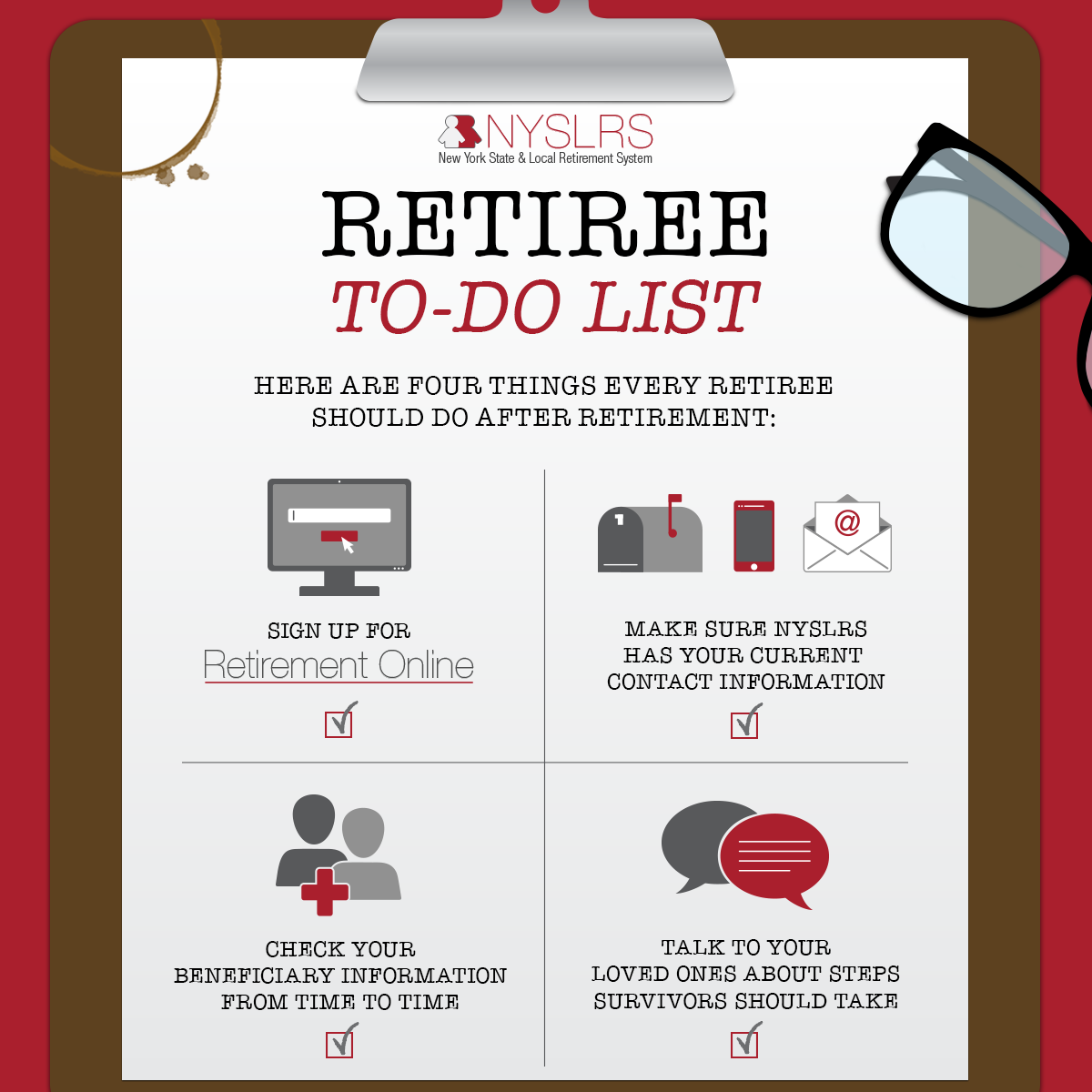

There are a few things you should do regarding your NYSLRS benefits after you retire. This way, wherever your retirement takes you, we can continue to provide you with the benefits and services available to our retirees.

Sign Up for Retirement Online

If you don’t already have a Retirement Online account, this is a great time to sign up. Retirement Online provides a secure and convenient way to check important NYSLRS information, like the deductions from your latest payment and a summary of your benefits. You can also view or update beneficiary information and generate pension income verification letters right from your computer. We’ll be adding additional online features for retirees in the near future, so stay tuned.

Have New Contact Information? Let Us Know

If you move after you retire, let NYSLRS know your new address so you can be sure to get important communications about your benefits.

The Post Office usually won’t forward pension checks to another address. If you haven’t already, you can sign up for our direct deposit program. It’s the safe, hassle-free way to receive your monthly benefit. But there are other things you’ll want to receive from us after you retire, such as:

- Your 1099-R form. Your pension isn’t taxed by New York State, but it is subject to federal income tax.

- Your Retiree Annual Statement. It’s a helpful reference that spells out the benefits, credits and deductions you receive each year.

- Any official notifications such as a net change in your benefits.

- Your Retiree Notes newsletter.

There are several ways to update your address. The fastest way is through Retirement Online. Or, you can complete our secure contact form for street addresses within the United States. Be sure to fill out the entire contact form and provide both your old and new addresses.

You can also complete a Change of Address Form (RS5512) and mail it to:

NYSLRS

110 State Street

Albany, NY 12244-0001

You should also make sure we have your current email address. Having an email address on file means we can contact you quickly if we need to notify you about an update to your NYSLRS benefits. If you haven’t updated your email address with NYSLRS, update it in Retirement Online, send it to us using the secure email form or send it to us with your Change of Address Form (RS5512).

Keep Your Beneficiary Information Current

Reviewing your beneficiary designations periodically is important. By keeping them up to date, you ensure that any post-retirement death benefit will be distributed to your loved ones according to your wishes. You can use Retirement Online to change your death benefit beneficiaries at any time, or contact our Call Center and we will send you the necessary form.

Read Our Guide for Retirees

Check out our publication, Life Changes: A Guide for Retirees (VO1705), for information about other benefits you may be entitled to and the services we offer after you retire.

I retired mid 2021. Since there was no 2022 paystub viewable I did not know my federal tax withholding was ZERO. I had pension payments for second half of 2021 and there was a small federal tax withheld but the 2022 W2 shows ZERO. Am I required to check/update that withholding info annually? Why did it seemingly change with no input from me?

Your message is important to us, and we have sent you a private message in response.

All of my paperwork has been received by nyslrs on May 23, 2022. The retirement date i selected on the Retirement application is A.S.A.P. Will selecting A.S.A.P. delay my retirement? For it’s been beyond 15 days since the system received my paperwork and i have yet to receive a date.

For assistance with the status of your application, please call our customer service representatives at 866-805-0990 (518-474-7736 in the Albany, New York area), press 2 for members, then follow the prompts.

Retirement Online is great, but it doesn’t work overseas. What about your retirees that are retiring abroad? Any plans to make it accessible to them? Thanks!

Unfortunately, Retirement Online is not accessible to customers outside of the United States and Canada. This is to safeguard your personal information and keep your account secure. If you need to do business with NYSLRS, you can email us using our secure contact form or download forms you need from our website.

This is a big issue for me as well. You would think with all the 2FA and other security methods in place the retirement system would get current technology like many multi-billion dollar companies currently have in place. Common NYSLRS, get with the current technology and support your retirees with what they need.

I’m retiring soon, I already have direct deposit setup with my job. Can I just keep that setup? Or I’ll need to set it up with NYS?

You will need to set up direct deposit with NYSLRS to receive your pension payment by direct deposit.

If you file for a service retirement benefit using Retirement Online, you can sign up for direct deposit during the application process. If you file for retirement by mail, you can complete and submit a Direct Deposit Application (RS6370) with your mailed retirement application.

My question is about recalculation for vacation and sick time

I will have been retired 26 months as of July and it still shows up as NEW on my retirement online account……..im wondering how long this takes or have i fallen through the cracks, others that i have worked with have had theirs done in 3-6 months can you give me some information?

When you retire, your pension payment is based on the salary and service information we have on file for you at retirement. In some cases, slight adjustments are made to the initial amount after we receive and process final payroll information from your employer. These recalculations are processed in date order and are generally minimal compared to the overall benefit amount.

Once we have all the information we need and we finalize your benefit amount, if your payment increases, you will receive a retroactive payment for the amount you are owed back to your date of retirement.

I also have been waiting over a year for my recalculation. When I had my consultation they said i would receive 90% for six months. i retired expecting an increase after 6 months. I feel I was mislead as I would not have retired when I did had I known.

When you retire, your pension payment is based on the salary and service information we have on file for you at retirement. In some cases, slight adjustments are made to the initial amount after we receive and process final payroll information from your employer. These recalculations are processed in date order and are generally minimal compared to the overall benefit amount.

Once we have all the information we need and we finalize your benefit amount, if your payment increases, you will receive a retroactive payment for the amount you are owed back to your date of retirement.

8 months later and I am still waiting for my final calculation. As I stated before when I retired Your representative told me I would only receive 90% of my benefit until the final calculation. Is that correct or is it incorrect like the six months they told me it would take? Also how much longer before I have the final calculation?

Your message is important to us, and we have sent you a private message in response.

I’ve been given the same answer about the excessive length of time it will take to recalculate my vacation and sick time into an adjusted pension and been handed the reasoning they are overloaded with work due to the many people that retired during the pandemic. In my case the wages, vacation and sick time were provided at the same time as the retirement. My adjusted calculation should have been done all at once. But when I asked about it, I was told they are backed up, behind, and it may take a couple years for them to get to it. They justified it by stating they do a lot more than just calculate a retirement. My response to that is it’s ridiculous. Retirement is the sole purpose of “NYS Retirement System” and therefore it should not be taking any more time to calculate the extra than it did to calculate the initial figure. I was previously in payroll for hundreds of employees and although my main role was to provide employees a paycheck, I also calculated employer taxes, 401K distribution, and insurance premiums, among other duties. How would it have worked out for my job security if I would have said that I was busy, behind schedule, and I’d have to calculate someone’s overtime, vacation, or bonus pay when I get caught up?…And that it may take a year or two but I’ll send it retroactively when I catch up? Doesn’t that sound silly? Dear NYS Retirement folks, we need you to complete the job when it is due, just as the rest of us did our jobs timely which qualified us to earn this retirement in the first place. I’m about to hit 10 months since my retirement so my wait hasn’t been as long as some others, but the point is we deserve to have an accurate monthly pension from the start (regardless if the adjustment was “minimal”).

I’ve been retired 39 months and

my recalculation also shows NEW.

It is so frustrating. I would hope to be a priority after 3yrs. 1 mo.

Not so …

So NYSLRS, I don’t believe you answered our question about recalculation. How long is it going to take once we retire to receive our recalculation ? 3 years is insane. You guys are holding into a lot of money here and with this inflation, we need it. Now ! Please advise

Your message is important to us, and we have sent you a private message in response.

After 3 yrs……

It seems like at some point we would go on a preferred list.

In my opinion, there’s no excuse at this point.

Your message is important to us, and we have sent you a private message in response.

I retired in June of 2021 and was told NYS was (2) years behind on the final calculations…. How far behind are you now?

Virtually all initial pension payments are made timely by the end of the month following retirement. These payments are closer than ever to a retiree’s final calculation. NYSLRS often receives adjustments to earnings for retirees well after the date of retirement and is working hard to recalculate pension amounts and provide retroactive payments as quickly as possible. We apologize for the length of time this has taken for some retirees. Thank you for your patience.

Requested 3 times now to correct the spelling of one of my beneficiaries. I have not received confirmation that it has been done. I also have written to request to sign up for an online account as attempt to sign up results in a failure notification.

Your message is important to us and we have sent you a private message in response.

Wish I knew “what to do when I retire”, I went on sick leave due to an injury ( used all of my sick time- which ended up stopping my health benefits). I never realized Workman’s compensation covered my injury. When it was reviewed, I ended up receiving compensation, but my health benefits were not restored. A few years later NYS retired me from my state agency, still with no health benefits. So now I only have Medicaid and Medicare. ☹️

Thanks for the information. Whom do I contact if I have not received my monthly Pension Statement for the past two months?

Retiree Annual Statements are mailed out once a year at the end of February. It shows a summary of your total retirement benefit paid for the previous calendar year.

If there is a change to your net monthly benefit, we send you a letter explaining the change. Otherwise, you can look up a breakdown of your monthly pension payment in Retirement Online. Retirement Online displays up-to-date information about your account. If you don’t already have an account, go to the Sign In page and click the “Sign Up” link under the “Customer Sign In” button.

If you have questions, you can call our customer service representatives toll-free at 1-866-805-0990.