As you plan for retirement, you need to think about your sources of income in retirement. However, you should also consider how long your retirement income will need to last.

Longer Life Span, Longer Retirement

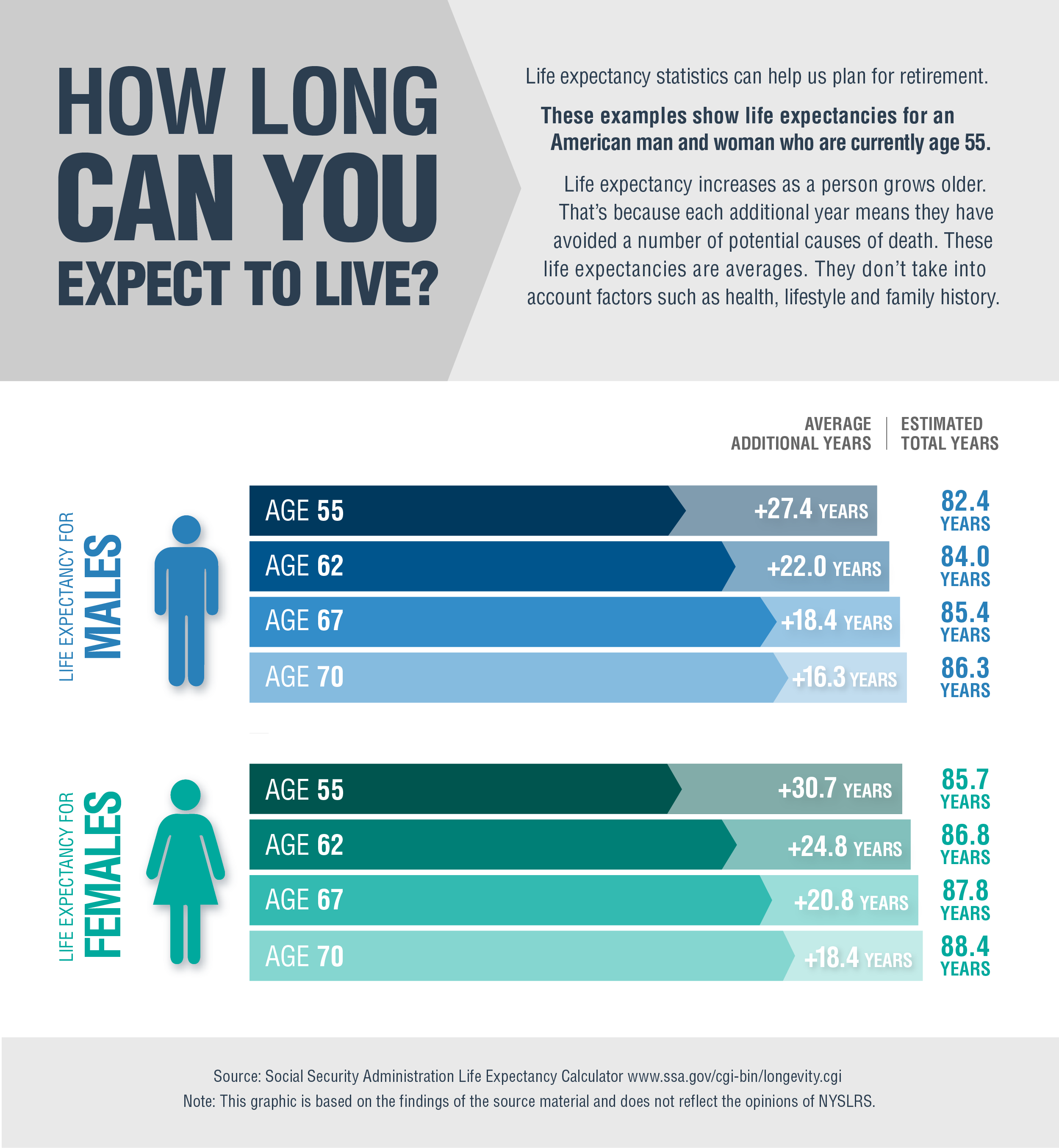

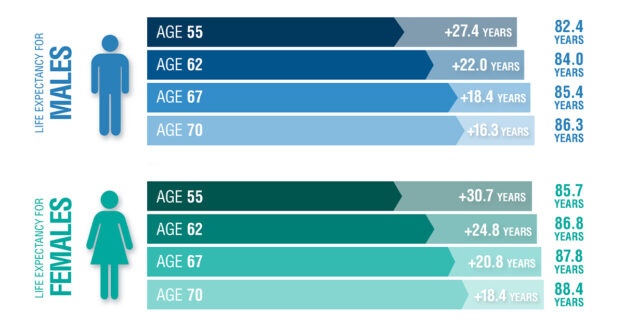

These days, a 55-year-old man can expect to live for another 27.4 years, to about 82. A 55-year-old woman can expect to live for more than 30 years. These figures, derived from the Social Security life expectancy calculator, are only averages. They don’t account for factors such as health, lifestyle or family medical history.

Here are some other statistics worth considering as you plan for retirement (as of the State fiscal year that ended March 31, 2022):

- More than 37,000 NYSLRS retirees were over 85 years old;

- More than 3,500 had passed the 95-year mark; and

- 401 NYSLRS’ retirees were 101 or older.

Considering that many public employees can retire as early as 55, it’s possible that a fair number of them could have retirements that last 45 years or more.

Saving for a Long Retirement

Your NYSLRS pension is one source of income that you can depend on however long your retirement lasts. Employees’ Retirement System (ERS) members who retired in fiscal year 2022 are receiving an average monthly pension of $2,748. Social Security is another long-term source. The average Social Security benefit for a retired worker was $1,837 a month, as of June 2023.

Your retirement savings is a crucial asset that can supplement your pension and Social Security. In a long retirement, savings can help with rising costs and provide a source of cash in an emergency.

It is never too late to start saving for retirement. The New York State Deferred Compensation Plan is one easy way to get started. It’s a program created for New York State employees and employees of participating public agencies. If you’re a municipal employee, ask your employer if you’re eligible for the Deferred Compensation Plan or another retirement savings plan. (The New York State Deferred Compensation Plan is not affiliated with NYSLRS.)

You should also visit our Start Saving for Retirement page. You’ll find an example of how much you can save over a 30-year period, and a sample withdrawal strategy designed to provide retirement income for 20 years.

Your NYSLRS Pension Benefit

Your NYSLRS pension is a lifetime benefit that will provide monthly payments throughout your retirement. Get a head start on your retirement planning and estimate your pension in Retirement Online.

How about finalizing our retirement figures more timely? I’ve been retired 2 years and am still receiving an estimated amount that I know is lower that what I’m owed AND NEED. I think there are probably many other retirees that feel the same.

Yes I agree. I also have been waiting for 2 years 7 months.

NYSLRS is working hard to recalculate pension amounts and provide retroactive payments as quickly as possible. We apologize for the length of time this has taken for some retirees. NYSLRS often receives adjustments to earnings for retirees well after the date of retirement. Once we complete your recalculation, you will receive payment of all the money you are owed, and a letter explaining the change in your pension amount. Thank you for your patience.

It is time to consider updating the COLA.

Why don’t you increase the bases upon which colas are bases. You can submit a bill on your own to do it and shepherd it through the Legislature. You can even base is on 100 of the inflation rate instead of only 1/2 the inflation rate up until $18,000.