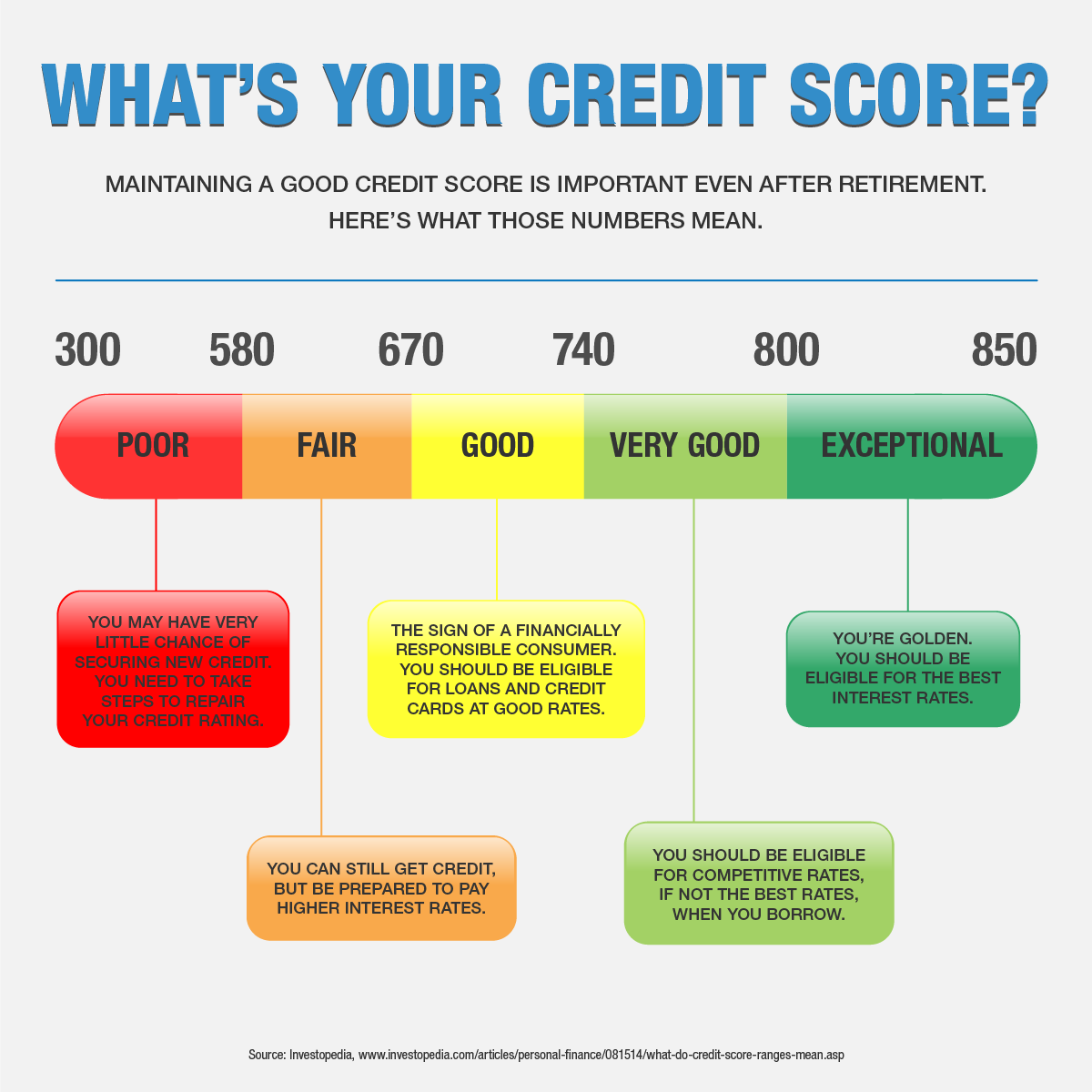

Throughout your working years, you strived to maintain good credit. But if you’re retired, or about to retire, is a good credit score that important? The answer is yes, according to many financial experts. You don’t want to be burdened with debt in your retirement years, but you may need to get a car loan or refinance a mortgage. A good credit score will assure you can borrow the money at a decent interest rate.

But your credit score can affect you even if you don’t borrow money. A bad credit score could prevent you from landing a job or renting an apartment. It could even force you to pay higher insurance premiums.

Fortunately, maintaining a good credit score is not that difficult. In most cases, it’s a matter of continuing what you’ve already been doing.

How to Maintain a Good Credit Score

- Pay your bills on time. Your payment history accounts for about a third of your credit score.

- Don’t max out your credit cards. The ratio of debt to available credit is also a big factor. If all your credit cards have balances near the limit, your credit score will suffer.

- Don’t close credit card accounts you’ve had for a long time. These accounts show your long history of being responsible with credit, helping to boost your score.

- Check credit reports. Even if you’re doing everything right, misinformation in the files of credit rating companies can hurt your credit. (And, no, requesting a credit report will not hurt your credit score.)

Things like age and salary are not part of the credit score equation, so being retired does not hurt your score. However, lenders do take income into account when you apply for a loan, so you may find it harder to borrow after retirement, even if you have good credit.

Checking Credit Reports

Under federal law, the three nationwide credit reporting companies are required to provide you with a free credit report once every 12 months. But you must request it. You can do it online at www.annualcreditreport.com or by calling 1-877-322-8228. (AnnualCreditReport, a website maintained by the three major credit reporting agencies, is the only free-credit-report site authorized by the federal government. Beware of impostor sites.)

manages more than 300 retirement plan combinations for its members, which are described in more than 50 plan booklets. But, for all that complexity, they breakdown into just two main types: regular plans and special plans. Under a regular plan, you need to reach certain age and service requirements to receive a pension. For instance, if you’re a Tier 4 member in the Employees’ Retirement System (ERS) with a regular plan, you’re eligible for a benefit when you turn 55 and have five or more years of service credit. Most of our ERS members are in regular plans.

manages more than 300 retirement plan combinations for its members, which are described in more than 50 plan booklets. But, for all that complexity, they breakdown into just two main types: regular plans and special plans. Under a regular plan, you need to reach certain age and service requirements to receive a pension. For instance, if you’re a Tier 4 member in the Employees’ Retirement System (ERS) with a regular plan, you’re eligible for a benefit when you turn 55 and have five or more years of service credit. Most of our ERS members are in regular plans.