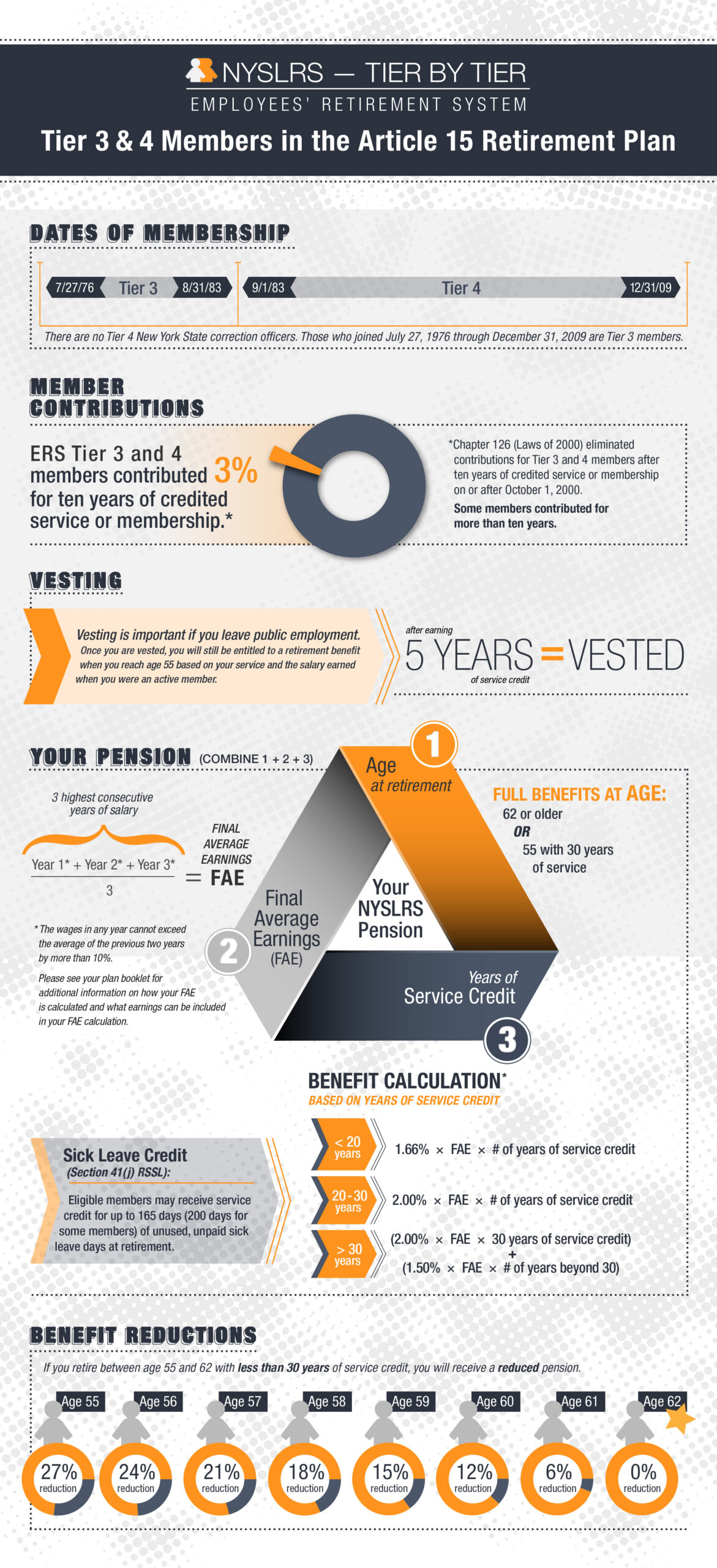

When you join the Employees’ Retirement System (ERS), you are assigned a tier based on your date of membership. You are in:

- Tier 3 if you joined July 27, 1976 through August 31, 1983.

- Tier 4 if you joined September 1, 1983 through December 31, 2009.

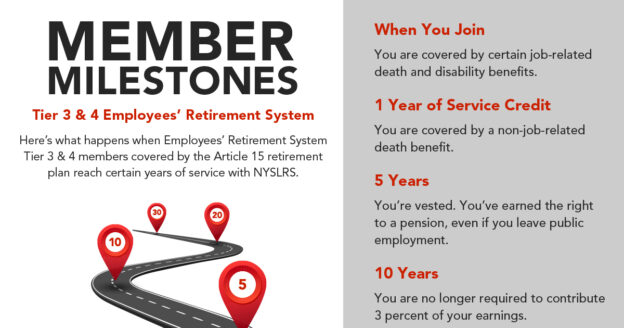

Let’s look at the ERS Tier 3 and 4 milestones and how they affect your benefits.

Why Milestones Matter

As a NYSLRS member, you earn service credit for your paid public employment. Generally, one year of full-time work equals one year of service credit. As you earn service credit, you’ll reach career milestones that will make you eligible for certain benefits or for increases to your existing benefits. Understanding these milestones can help you plan for retirement.

Your ERS Tier 3 and 4 milestones and pension calculation depend on your retirement plan, so it is important to familiarize yourself with the details of your plan. Most ERS Tier 3 and 4 members are in the Article 15 retirement plan (named for a section of the New York State Retirement and Social Security Law). If you see Plan A15 listed in the ‘My Account Summary’ section of your Retirement Online account, you’re in this plan. For members not covered by the Article 15 retirement plan, visit our website to Find Your NYSLRS Retirement Plan Publication.

Important ERS Tier 3 and 4 Milestones

Here are some additional important milestones for Tier 3 and 4 members in the Article 15 retirement plan:

- With ten years of service credit, you can apply for a non-job-related disability benefit if you are permanently disabled and cannot perform your duties because of a physical or mental condition.

- With ten years of service credit, your beneficiaries may be eligible for an out-of-service death benefit if you leave public employment and die before retirement.

- Ten years also marks the point when you are no longer able to withdraw your membership and receive a refund of your contributions if you leave public employment.

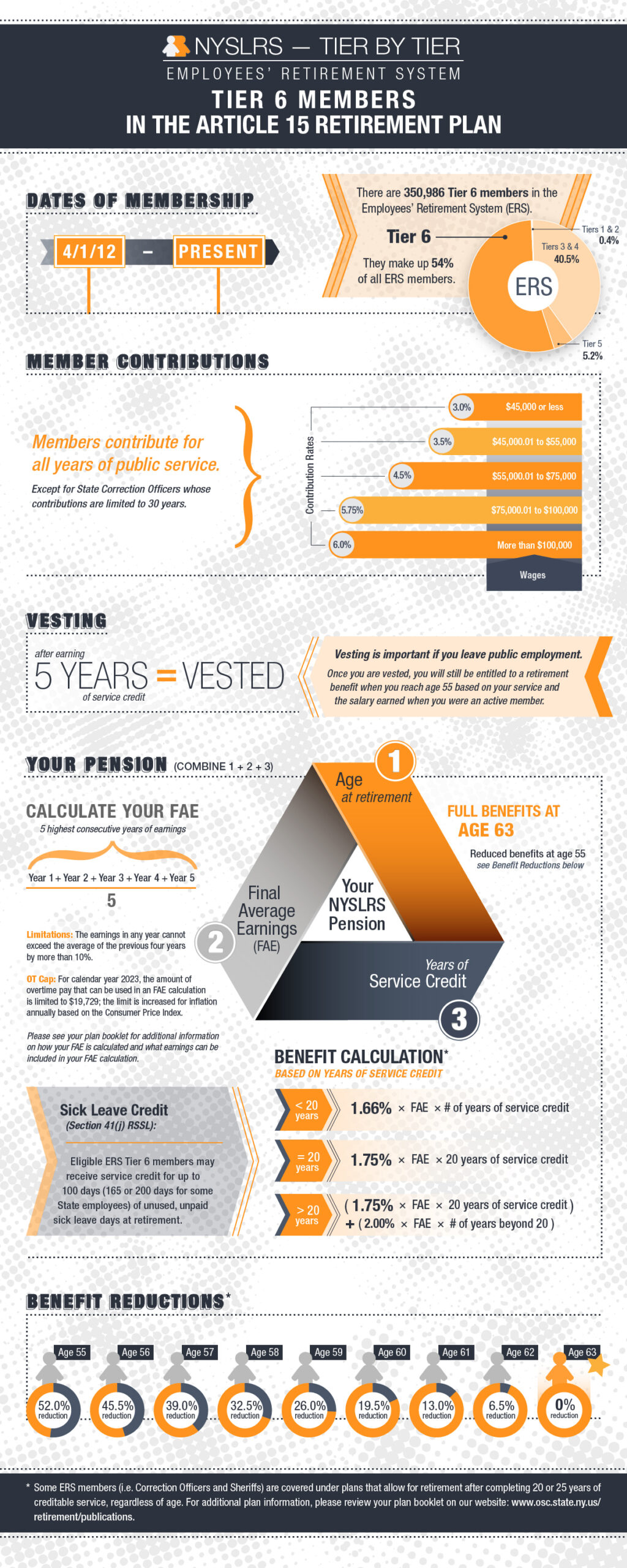

- You are eligible to retire once you are age 55 and have five years of service credit. However, for most Tier 3 and 4 members, there would be reductions to your benefit if you retire before age 62 with less than 30 years of service credit.

- You can retire with full benefits at age 62.

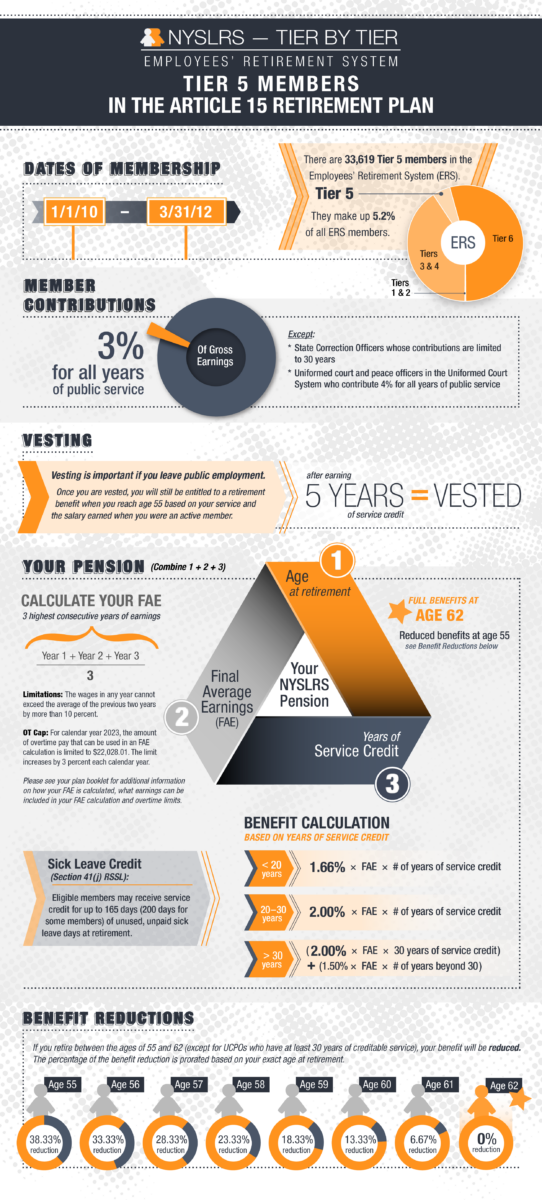

- If you retire with less than 20 years of service, your pension will equal 1.66 percent of your final average earnings (FAE) for each year of service.

- If you retire with 20 to 30 years of service, your pension will equal 2 percent of your FAE for each year of service.

- For each year of service beyond 30 years, you will receive 1.5 percent of your FAE.

Note: When you retire, your FAE will be based on the average of your three highest consecutive years of earnings. The law limits the FAE of all members who joined on or after June 17, 1971. Read our blog post, Calculating Your Final Average Earnings, for more information, including how your FAE will be calculated and limitations.

Most members can estimate their pension in Retirement Online. You can fine tune your estimate by entering your annual earnings and expected pay increases. You can also include any service credit you plan to purchase.