Welcome to the New York State and Local Retirement System (NYSLRS).

What is NYSLRS? NYSLRS administers retirement benefits for New York State employees and municipal and non-teaching school district employees outside of New York City. With nearly 1.2 million members, retirees and beneficiaries, NYSLRS is one of the largest public retirement systems in the nation.

NYSLRS is here to help you plan a financially secure retirement. Retirement may seem like a distant concern, but decisions you make now will have a big impact on your post-work life. Here are a few things you should do now as a new member:

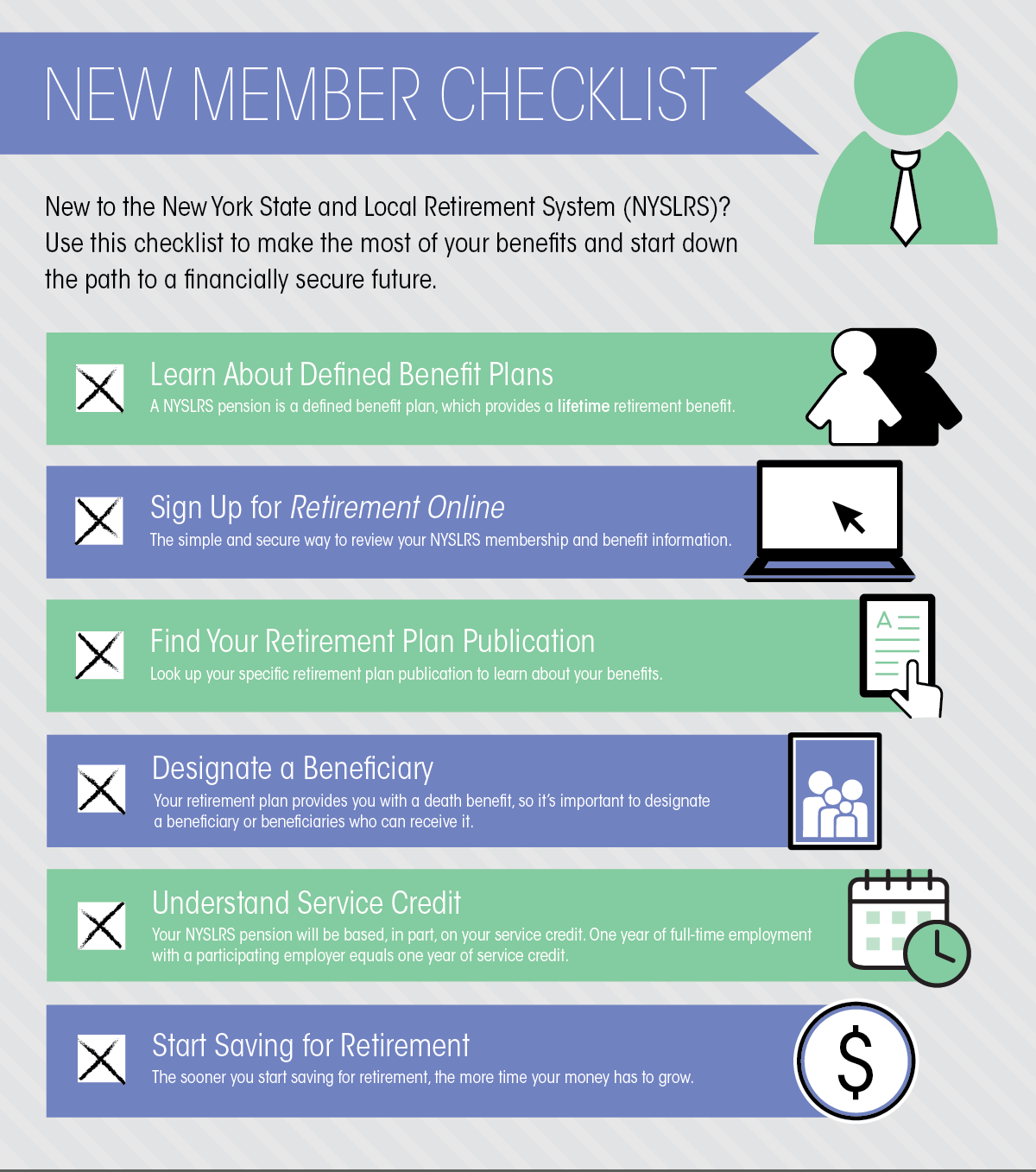

Checklist for New Members

Learn About Defined Benefit Plans

Your NYSLRS pension is a defined benefit plan. This means that, once you are eligible and apply for retirement, you are guaranteed a monthly pension payment for the rest of your life. The amount of your payments will be calculated using a formula set by State law.

Defined benefit plans should not be confused with 401(k)-style retirement savings plans, which are known as defined contribution plans. The value of these plans is limited to the contributions made to an individual’s account and the investment returns on those contributions. And, unlike your NYSLRS pension, these plans do not guarantee a lifetime benefit.

While a 401(k)-style retirement savings plan can supplement a pension and Social Security benefits, it does not provide the same level of financial security as a defined benefit plan.

Sign Up for Retirement Online

If you haven’t already, sign up for a Retirement Online account. You can use Retirement Online to look up your estimated total service credit, name a beneficiary for your death benefit, purchase past service credit and more. This online tool will be an important resource throughout your career, especially as you plan for retirement when you can use our benefit calculator to estimate your pension.

Find Your Retirement Plan Publication

Your retirement plan publication is an essential resource that provides comprehensive information about your NYSLRS benefits. You can look up your specific plan using our Find Your NYSLRS Retirement Plan Publication tool. All you need is your benefit plan code and Tier, which you can find in Retirement Online.

Designate a Beneficiary

Your retirement plan provides you with a death benefit, so it’s important that you designate a beneficiary or beneficiaries. You can designate a beneficiary or beneficiaries through Retirement Online or by mailing us a Designation of Beneficiary form (RS5127).

Understand Service Credit

Your NYSLRS pension will be based on factors such as your tier, retirement plan, age at retirement, final average earnings and your service credit. You’ll earn one year of service credit for every year of full-time employment with a participating employer. Part-time employment is prorated. If you worked for a public employer or served in the U.S. armed forces before you were a member of NYSLRS, you may be eligible to receive credit for that past service. Because it is a major factor in calculating a NYSLRS pension, additional service credit would increase your pension in most cases. You can request this service through Retirement Online or by mailing us a Request to Purchase Service Credit (Including any Military Service) form (RS5042).

Start Saving for Retirement

Your pension is only one part of a secure financial future. It’s a good idea to save additional money for retirement. Healthy retirement savings will give you more flexibility to do the things you want to do in retirement. They also can be a hedge against inflation and a source of cash in an emergency. You don’t want to wait to start saving; the sooner you do, the more time your money has to grow.

More Information

Visit our Welcome New Members page for more information about NYSLRS and your benefits.

I have been trying in vain to schedule a consultation out of the Hauppauge office. Is there any possible way to connect? A secret phone number with less than an hour wait time perhaps?

We’d like to help resolve your issue. Your message is important to us, and we have sent you a private message in response.

I would like to know if the sick time you have has any value towards your medical plan.

NYSLRS does not administer health insurance programs. Please contact your employer’s health benefits administrator for questions about how your sick time can affect your coverage.