The 15-day waiting period for a NYSLRS member’s retirement to take effect has been temporarily waived by a governor’s executive order. The waiver, which was requested by Comptroller DiNapoli, is designed to protect families who may lose a loved one to COVID-19 before a member’s retirement is official.

Under the waiver, if you plan on filing for retirement through July 5, 2021, you can choose a date of retirement less than 15 days away.

Members seeking to service retire should also choose a pension payment option. This is especially important if you wish to name a beneficiary to receive a pension benefit in the event of your death.

Eligible members can file for retirement, choose a date of retirement as early as the next day, and upload retirement-related documents using Retirement Online.

If you choose to file a paper retirement application, you can choose a specific retirement date, or enter “ASAP” and your date of retirement will be the day after your filing date. Find more information about filing for retirement (online or by mail) in our recent blog post, Retirement Online Makes Applying for Retirement Fast, Easy.

A member may withdraw their service retirement application up until the day before they retire.

The waiver will also be effective for members who filed after March 7, 2020 and died due to COVID-19. If these members selected a pension payment option that provides a continuing pension benefit for a beneficiary after their death, and they died of COVID-19, their beneficiary will receive the monthly benefit under the pension payment option that the member chose.

“Many government workers are battling the coronavirus in their communities every day,” New York State Comptroller Thomas P. DiNapoli said. “God forbid something should happen to them before their retirement becomes effective. Waiving the waiting period after filing for service retirement benefits ensures their families will get the benefits that were intended for them. My thanks to Governor Cuomo for acting on our request and taking steps to protect our heroic state and local workers and their families in these tough times.”

The executive order waives the legal requirement that a NYSLRS member’s retirement application be received by the Office of the State Comptroller at least 15 days before their retirement date.

To be eligible for a service retirement benefit, a vested NYSLRS member must be at least 55 years old, unless they are in a special plan that allows retirement after 20 or 25 years regardless of age. For details about NYSLRS service retirement benefits and death benefits, please check your retirement plan booklet, which you can find on our Publications page.

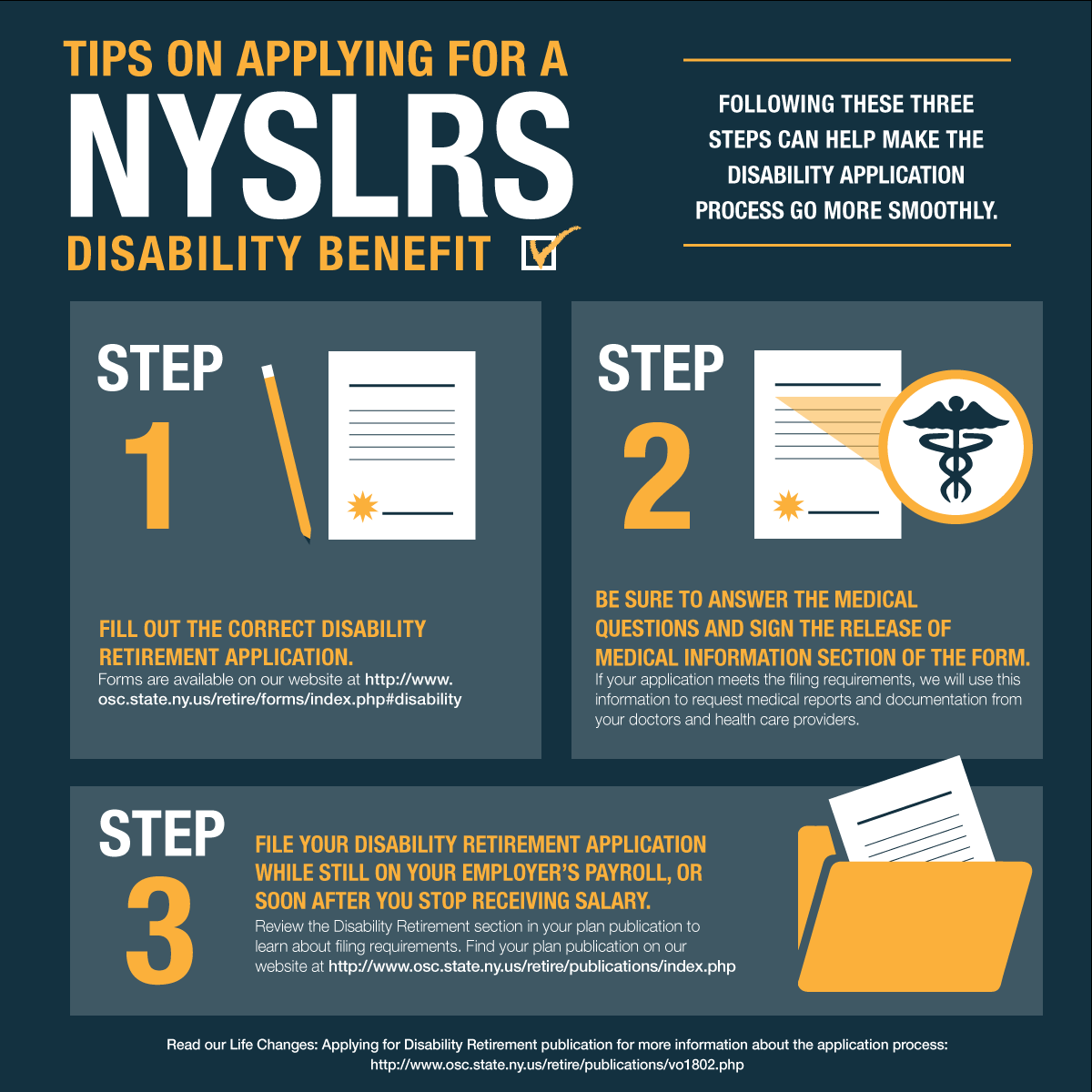

Members who are not yet eligible for a service retirement benefit may want to read our recent blog about applying for a disability retirement benefit.