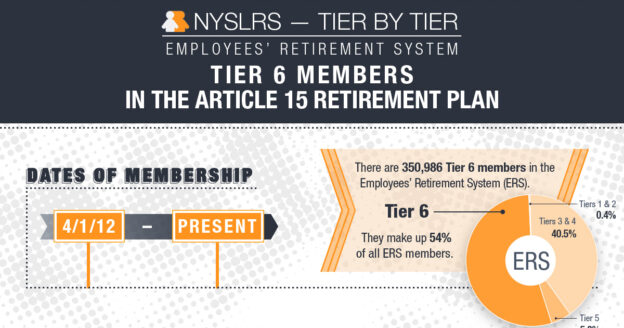

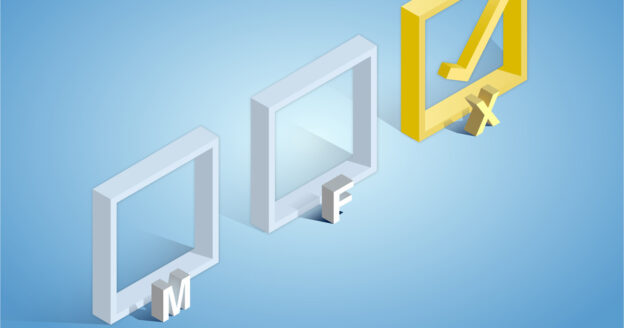

When you join the New York State and Local Retirement System (NYSLRS), you’re assigned a tier based on the date of your membership. This post looks at Tier 6 members of the Employees’ Retirement System (ERS).

Your tier determines such things as your eligibility for benefits, the calculation of those benefits, death benefit coverage and whether you need to contribute toward your benefits.

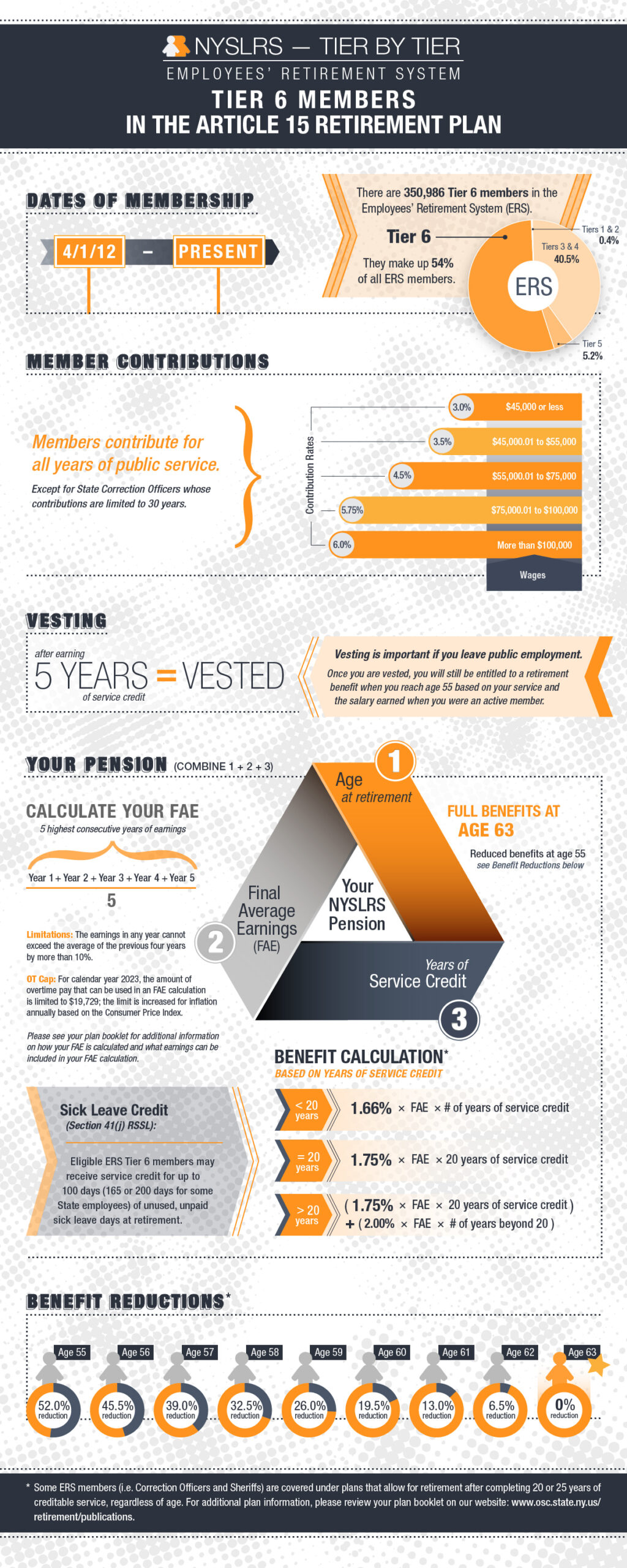

ERS has six tiers. Anyone who joined ERS on or after April 1, 2012 is in Tier 6. There were 350,986 ERS Tier 6 members as of March 31, 2022. At 54 percent of membership, Tier 6 is the largest ERS tier.

Most ERS Tier 6 members (unless they are in special retirement plans) retire under the Article 15 retirement plan. Check out the graphic below for the basic retirement information for Tier 6 members in this plan.

Membership Milestones

As of April 9, 2022, Tier 6 members only need five years of service credit to become vested. If you are a vested member in the Article 15 retirement plan, you are eligible for a lifetime pension benefit as early as age 55, but if you retire before the full retirement age of 63, your benefit will be reduced.

If you retire with fewer than 20 years, the benefit is 1.66 percent of your final average earnings (FAE) for each year of service. If you retire with exactly 20 years of service, the benefit is 1.75 percent of your FAE for each year of service (35 percent of your FAE).

If you retire with more than 20 years of service, you’ll receive 35 percent for the first 20 years, plus 2 percent for each additional year. For example, with 35 years of service you can retire at age 63 with 65 percent of your FAE.

Where to Find More ERS Tier 6 Information

For more information about ERS Tier 6 membership, find your NYSLRS retirement plan publication. It’s a comprehensive description of the benefits provided by your specific plan.

You can check your service credit total and estimate your pension using Retirement Online. Most members can use our online pension calculator to create an estimate based on the salary and service information NYSLRS has on file for them. You can enter different retirement dates to see how your choices would affect your potential benefit.

Members may not be able to use the Retirement Online calculator in certain circumstances, for example, if they have recently transferred a membership to NYSLRS, or if they are a Tier 6 member with between five and ten years of service. These members can contact us to request an estimate or use the “Quick Calculator” on our website. The Quick Calculator generates estimates based on information you provide.