Your Member Annual Statement is a snapshot of your NYSLRS account with information about your NYSLRS membership and benefits. It is based on the information we have on file for you as of March 31, 2023, the end of our fiscal year.

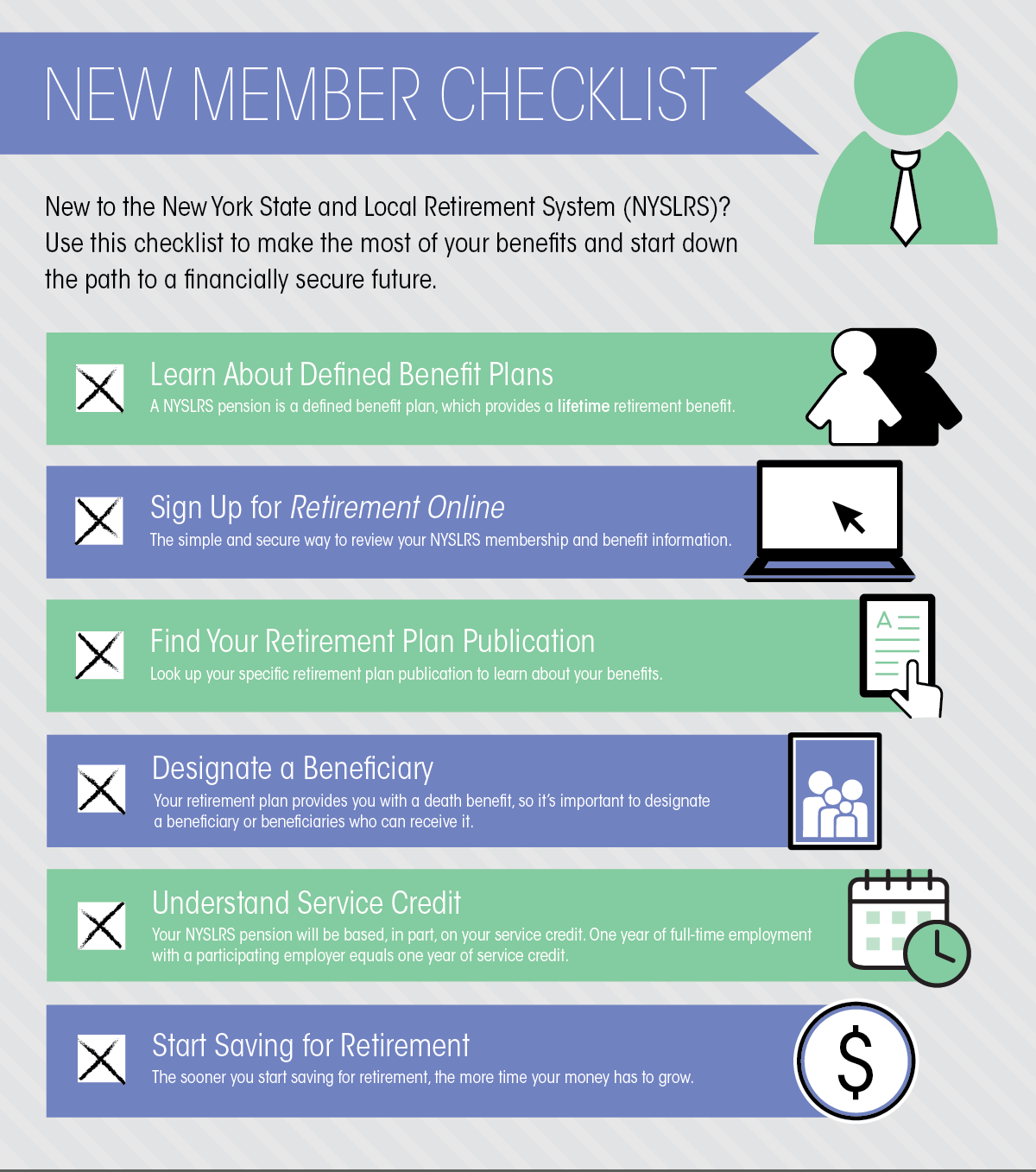

You can view your 2023 Statement now by signing into Retirement Online. From your Retirement Online Account Homepage, go to the ‘My Account Summary’ area, click the “View My Member Annual Statement” button and follow the steps to view, print or save your Statement. Don’t have an account? Register today. If you need help signing in to your account, these tools and tips will come in handy.

Delivery of Your Member Annual Statement

If you chose email delivery of your Statement, you should receive an email informing you that your Statement is ready to be viewed in Retirement Online. All other members will receive their 2023 Statement by mail before the end of June.

Get Up-to-Date Account Information Year Round

Your Member Annual Statement provides information as of March 31, 2023, but with Retirement Online you can access up-to-date information about your retirement account year-round. Sign in to see the date you joined NYSLRS, your tier, your retirement plan and your current total estimated service credit. Retirement Online is also the fast, easy way to conduct business securely with NYSLRS. Here are some of the things you can do:

Pension Estimates: Most members can create customized benefit estimates and calculate their pension payment options using Retirement Online. From your Account Homepage, scroll down to ‘My Account Summary’ and click the “Estimate my Pension Benefit” button. You can base your estimate on the salary and service information we have on file or adjust your earnings or service credit to account for possible increases in earnings or service credit purchases. By entering different retirement dates and beneficiaries, you will see how your choices affect your potential benefit. If you are not able to use the Retirement Online calculator, contact us for an estimate.

Employment History: You can view your recent employment history and reported earnings for the past five years in Retirement Online. From your Account Homepage, scroll down to ‘My Account Summary’ and click the “View My Recent Employment Summary” button. Think you may be eligible for past service that’s not included in your employment history? You can request to purchase service credit by returning to ‘My Account Summary’ and clicking the “Manage My Service Credit Purchases” button.

Contact Information Change: Did you move or change your email address recently? On your Account Homepage, in the ‘My Profile Information’ section, you can update your address and other contact information.

Update Your Delivery Preference for Next Year

Want to be notified by email next year when your Statement is ready? Sign in to Retirement Online to change your Statement delivery preference. Go to the ‘My Profile Information’ section on your Account Homepage, click “update” next to ‘Member Annual Statement By,’ then choose “email” from the dropdown menu.

Have Questions About Your Member Annual Statement?

Visit our Member Annual Statement page for answers to common questions or to find out how to correct any errors.

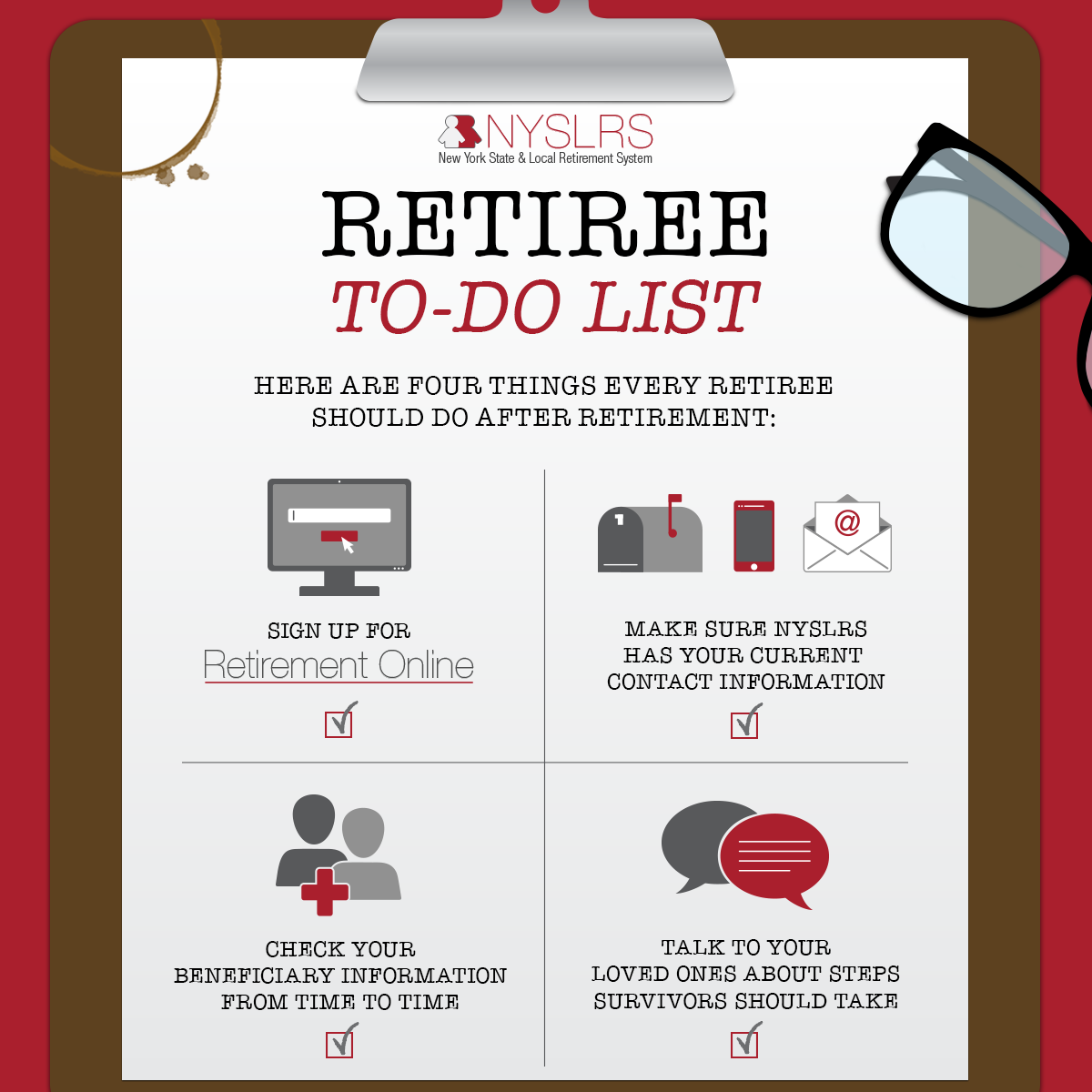

Reminder for retirees: Retiree Annual Statements were mailed at the end of February and are not yet available online.

After months or years of retirement planning, you’re probably looking forward to the day when you

After months or years of retirement planning, you’re probably looking forward to the day when you